Zero-based budgeting is all about creating a new budget from the ground up every fiscal year. It’s not the easiest way to budget but it helps businesses get a clear view into their operations and identify areas for cost savings.

Should your business adopt zero-based budgeting? It’s not for every business, but it could be just the thing for yours. Embracing zero-based budgeting can affect how you approach your operations and also contribute to your future business success. 🚀

IN THIS ARTICLE:

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowA short history of zero-based budgeting

Zero-based budgeting (ZBB) has been around for about fifty years. It’s arguably the most popular type of budget for personal finance but, also has significant applications in the world of business.

The concept of ZBB was first conceived in the 1960s by a young accounting manager at Texas Instruments named Peter Pyhrr. Mr. Pyhrr was looking for ways to help businesses cut costs, and came up with the idea of creating each new year’s budget from scratch, instead of the traditional method of starting with last year’s budget and making adjustments from there, known as incremental budgeting. 📝

ZBB garnered attention in the 1970s when President Jimmy Carter, elected on a promise to balance the nation’s budget during his first year in office ⚖️, introduced ZBB to the federal budget process. He had used zero-based budgeting while he was the governor of Georgia and liked the idea of justifying and approving each line item from scratch every year.

While the use of zero-based budgeting fell out of favor after Carter left office, it never went away. ZBB is frequently used for household budgeting and remains popular among small and medium-sized businesses (SMBs). Used along with a digital envelope money management system ✉️, a ZBB can help businesses get expenses under control and establish a foothold for future growth.

And it’s not just SMBs that can benefit from zero-based budgeting. According to a Gartner survey of global finance executives, 26% intend to use ZBB to help cut costs.

Zero-based budgeting is popular among small and medium-sized businesses looking to get expenses under control.

What is zero-based budgeting — and why is it important?

Zero-based budgeting essentially creates a brand-new budget each year, independent of any prior year's budget. Instead of basing a new budget on incremental changes from the previous year's budget or actuals, ZBB starts each new budget from zero and builds it up from there. 🌱

ZBB forces a company to reassess its business — especially its expenses. There are no expectations or assumptions based on past budgets or performance. Instead, every new budget is developed from the ground up, justifying each individual line item anew. Each new budget, then, is a new opportunity to right-size expenses and reevaluate the company’s overall progress. 🔃

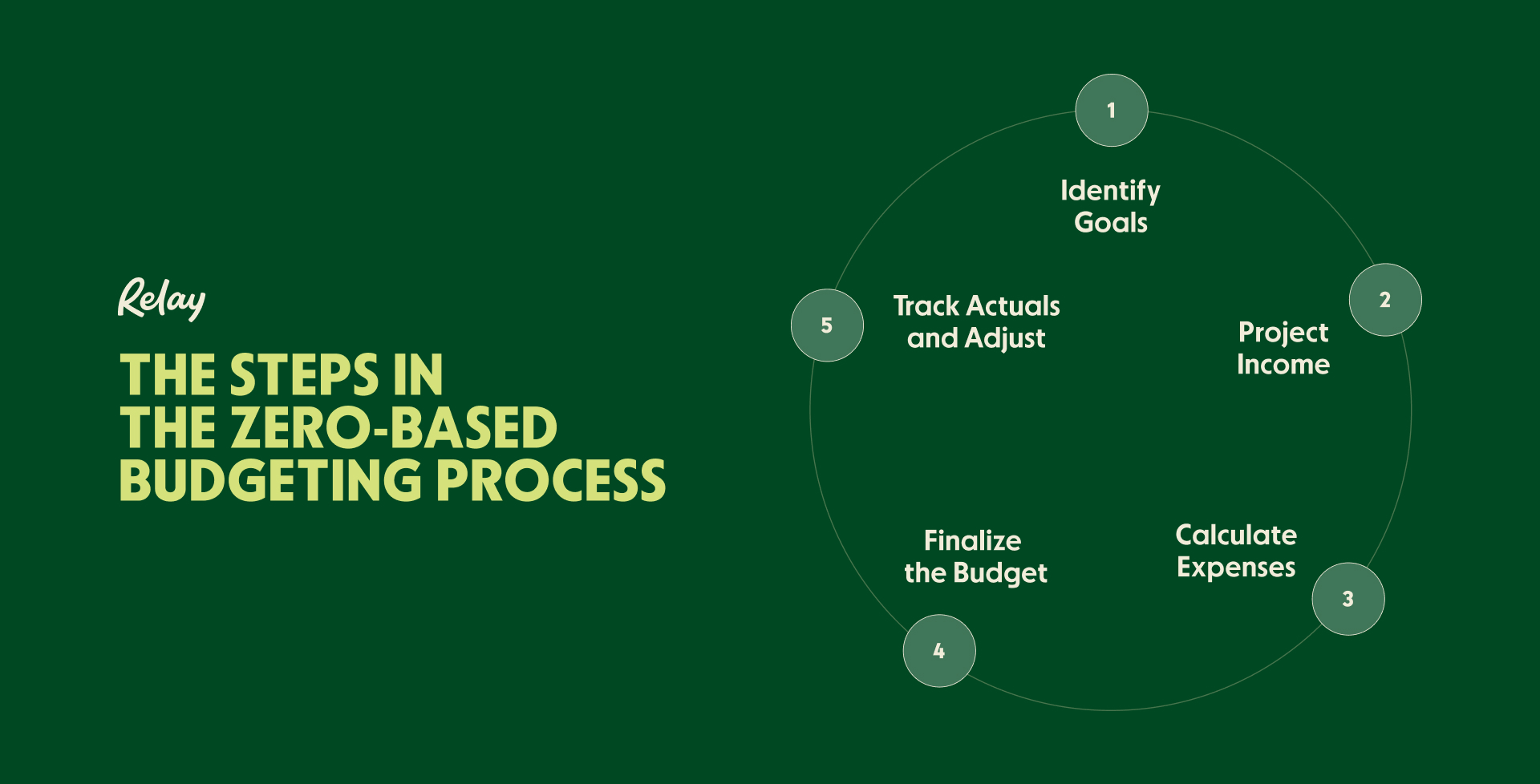

How to create a zero-based budget, step by step

Creating a zero-based budget isn’t that much different from any other budgeting process, you just have to start from zero every year. Even though creating a zero-based budget is simple in concept, however, it takes more time and effort than just incrementally adapting the previous year’s budget — which may be more work than you’re able or willing to do. With an incremental budget, a company must rethink every single expense and build the budget from scratch, line by line.

Let’s look at how to create a zero-based budget, step by step. 👇

Step 1: Identify sales goals

A zero-based budget is a budget created from the bottom up. Instead of basing revenue projection on a percentage increase (or decrease) from the previous year, each revenue source needs to be broken out separately. Then, for each source, projected sales need to be built from the bottom up, based on identifiable and achievable sales goals. 🎯

These sales projections should be done on a department-by-department (or location-by-location) basis, as granularly as possible. Forget what you sold last year. Instead, your sales team has to determine what is reasonable for each revenue stream in the coming year, factoring in customer needs, market conditions, competitors’ efforts, and overall economic conditions.

Step 2: Project your monthly income

The sales goals for each revenue stream now need to be combined and apportioned over a twelve-month period. Don’t forget to include additional or miscellaneous revenue—and recognize any seasonality in your monthly projections.

Step 3: Calculate all business expenses, from the ground up

Step three is the hard part. Every department in your organization needs to calculate 🧮expected business expenses for the coming year. They shouldn’t just look at prior-year expenses and bump the number up a bit. Instead, this calculation needs to be zero-based, identifying all expenses from the ground up. Just because you budgeted a line item last year doesn’t mean it still needs to be budgeted in the coming year. Every expense needs to be justified and assigned to the current pricing.

Step 4: Finalize the budget

Ideally, your projected income should equal or exceed your projected expenses. If not, you’re planning to run your business at a loss.

If, after the first round of a zero-based budget, you show too big a differential between revenues and expenses, you need to go back and reevaluate all of your assumptions and recalculate all of your numbers. In some larger organizations, the budget may go through several rounds before it’s finalized. 🔍

Step 5: Track actual income and expenses and adjust

With your budget complete, compare your actual income and expenses with your budget projections. If your projections differ too much from the developing reality, you may need to make some mid-stream adjustments.

If expenses are running ahead of plan or if sales are running behind, you may need to trim ✂️ upcoming expenses to compensate. If sales are running ahead of plan or expenses are lower than expected — well, that’s a very good thing and it means your business is going to be more profitable than expected. Just make sure you’re tracking every actual expense and booking all actual income, so you have a proper accounting of how things are going.

Step 6: Start all over again next year

At the end of the year (or, actually, a few months before year’s end), start the entire cycle all over again. Starting with step 1, you and your staff will create a new budget for the following year. 🔂

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowZero-based budgeting: An example

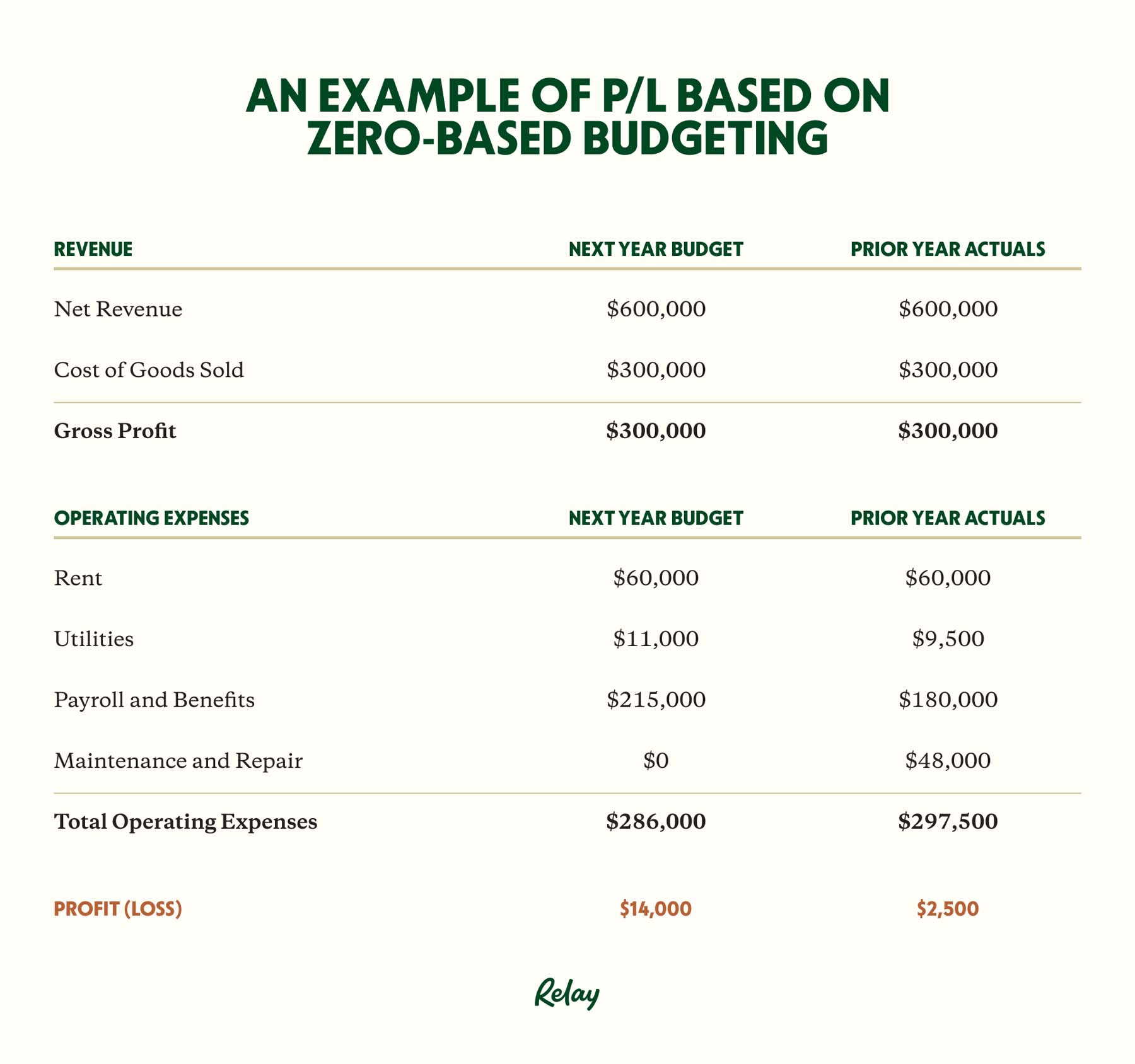

Let’s take a quick look at what a zero-based budget might look like. You can use this example as a zero-based budgeting template for your business. (For simplicity’s sake we’ll create an annual budget, not monthly budgets.)

Here are the facts. Last year, Company A had the following revenues and expenses:

Revenues hit $600,000

On those revenues, the company averaged 50% margins, so costs of goods sold (COGS) were $300,000

The company paid $60,000 in rent

Utilities ran $9,500 for the year

Payroll and benefits ran $180,000 for the year

Maintenance and repair costs were $48,000

Total expenses ran $597,500. Against revenues of $600,000, the company showed a profit of just $2,500.

⏩ Looking forward to next year, the company has prepared a zero-based budget based on these estimates:

Revenues from all channels, projected from the bottom up, are expected to remain flat, at $600,000

Margins are expected to remain steady, resulting in COGS of $300,000

There’s no increase in rent ($5,000 per month), so it’s still $60,000 for the year

Higher energy costs will cause utilities to increase to $11,000

Recognizing the high cost of outsourcing repairs and maintenance, the company is adding a new in-house maintenance position, at $35,000 per year, so payroll and benefits are budgeted at $215,000 for the year

By moving that maintenance in-house, outside maintenance and repair costs are zeroed out

Note that none of these items increased or decreased by a fixed percentage. Each line item is estimated from the ground up, based on current costs and conditions.

Each line item is estimated from the ground up, based on current costs and conditions.

As you can see in the following profit and loss (P/L) comparison, the company’s total expenses are now expected to run at $586,000. Against steady revenues of $600,000, that means that the company should generate a profit of $14,000. By using zero-based budgeting to recognize areas of potential cost savings, the company can dramatically increase its profit over the prior year. 💰

Zero-based budgeting vs. incremental budgeting

Companies typically have the choice between zero-based budgeting and the more traditional incremental budgeting. Both approaches have their merits and issues.

Understanding incremental budgeting

Incremental budgeting doesn’t start from zero. ❌ New budgets are based on prior-year budgets or actuals, with percentage increases or decreases factored in, depending on market factors. For example, a company might anticipate all expenses to increase by 10%, and create a budget with an overall 10% in expenses. This ignores any potential savings that could be applied to individual expenses — but it’s a lot easier to budget.

Comparing zero-based and incremental budgeting

Where traditional incremental budgeting is based on incremental changes to the prior year’s budget, zero-based budgeting does not look at that previous year’s budget or actuals. It creates a new ground-up budget each year.

Because of this, ZBB is much more time-consuming ⏱ than incremental budgeting. It’s easy to take an existing budget and change individual line items by a given percentage. It’s much more difficult to create a new budget from scratch.

On the other hand, ZBB is much better for getting a handle on the important details of a business, and for identifying areas where expenses can be reduced. According to Deloitte, companies using ZBB are more successful at meeting their cost targets. Incremental budgeting doesn’t provide the same granular look at expenses.

Zero-based budgeting is much better for getting a handle on the important details of a business.

Zero-based budgeting pros and cons

Knowing all this, what are the zero-based budgeting advantages and disadvantages? There are both pros and cons to moving to a ZBB.

Pros of ZBB 👍

The most significant benefits of zero-based budgeting include:

Identifying and decreasing wasteful spending

Holding managers and department heads accountable for costs

Helping to bring costs under control within the minimal negative impact on the business

Providing a more granular window into the entire business

Cons of ZBB 👎

The most significant limitations of zero-based budgeting include:

Takes a long time to prepare

Requires significant resources, company-wide

Requires multiple iterations based on management review

Encourages short-term thinking (next-year only) instead of longer-term strategic planning

Webinar: Turn Your Business Into a Money-Making Machine

Unlock the secrets to transforming your business from a job into a profitable, cash-generating machine.

Register NowHow to stick to your zero-based budget

Once you’ve created your company’s zero-based budget, how do you ensure you stick to it? Here are a few tips to make sure your entire company adheres to the budget you set—and doesn’t exceed planned expenses.

Track your spending 📊

It’s essential that you diligently track your spending versus the budget. Look at both month-to-date and year-to-date expenses, and if year-to-date expenses are veering too far from your budget, take action. You may need to cut spending for the balance of the year if you exceed your expense budget early.

Avoid unplanned expenses ❌

Even the most detailed ZBB is useless if you spend money you didn’t plan to. Some unplanned expenses can’t be helped (repairing broken equipment or facilities, for example), but try not to spend money on items or services you don’t need and weren’t in your budget.

Watch your revenues 👀

You also need to watch your revenues versus your plan. If revenues are consistently falling short, you’ll need to adjust your spending accordingly to avoid running in the red.

Use budgeting software 💻

Sticking to a zero-based budget is easier if you use small business budgeting software. Budgeting software, or money management platforms such as Relay, provide the tools you need to track performance and stay on budget. Relay’s cash management features, for example, help you spend, save, and plan more effectively — and provide unparalleled clarity into your expenses.

Zero-based budgeting can help build a successful business

The many advantages of zero-based budgeting far outweigh the additional time and resources required to build a budget from the ground up, 👏 especially for small and medium-sized businesses. When combined with Relay’s money management platform, you can not only create a zero-based budget but also successfully manage your performance to budget throughout the year.

Get started today to stay on track with your zero-based budget using Relay.