Looking for a business bank in Ohio? In this guide, we compare Relay, an online banking platform, and Wayne Savings Community Bank, a traditional bank.

Traditional banks, like Wayne Savings Community Bank, offer a blend of in-person and online services, and modern platforms, like Relay, provide a fully digital banking experience tailored for businesses. Let's delve deeper into what each institution brings to the table.

Table of contents:

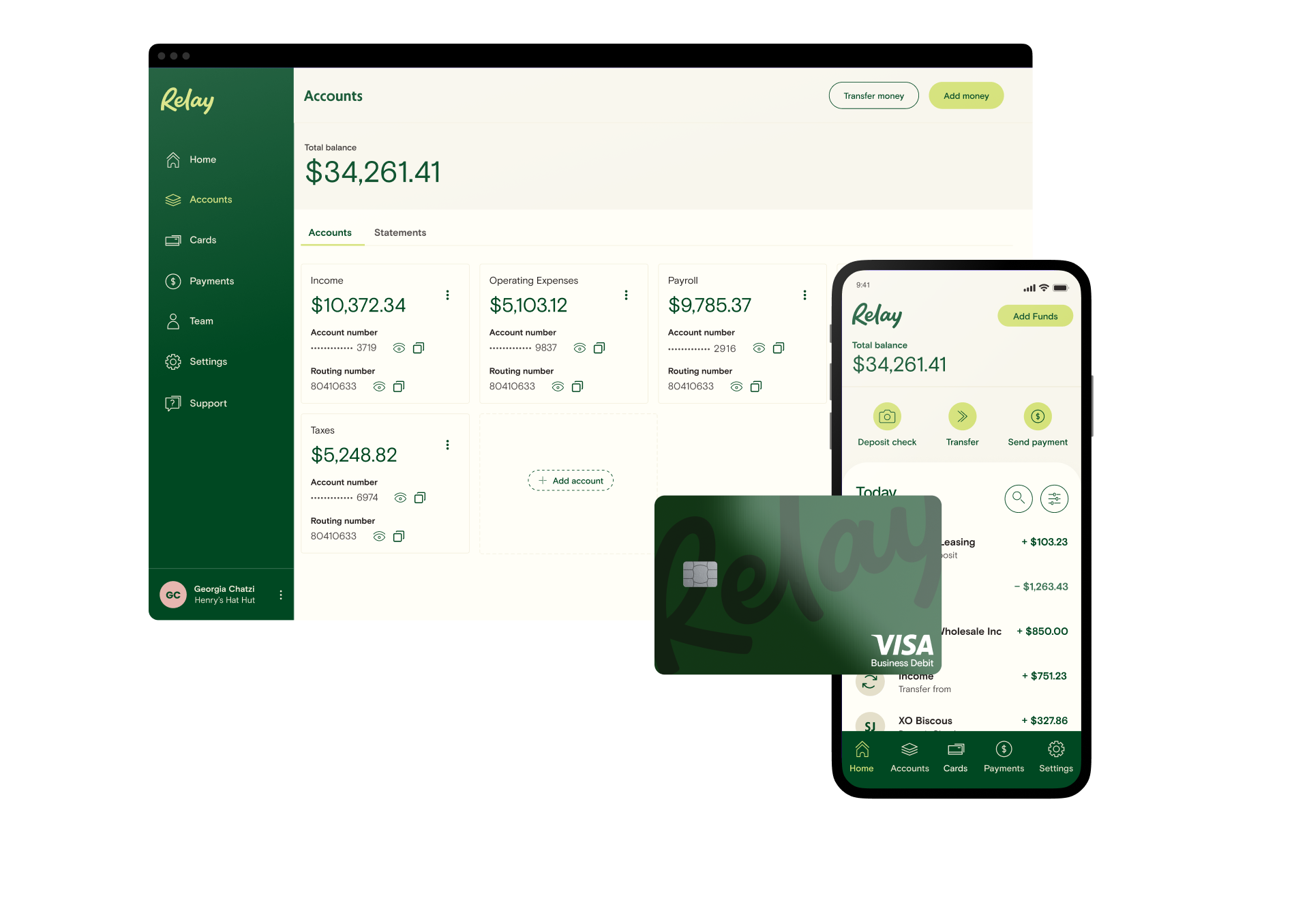

What is Relay?

Relay is a digital-first banking platform designed for modern businesses. With a focus on automation, integration, and user-friendly interfaces, Relay offers a suite of tools that make business banking seamless. From multiple checking accounts to direct integrations with popular accounting software, Relay is built for entrepreneurs who value efficiency and clarity in their financial dealings.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWhat is Wayne Savings Community Bank?

Established in Ohio, Wayne Savings Community Bank has been serving Wooster and the surrounding communities for years. It offers a blend of traditional banking services and provides specific tools and accounts tailored for businesses. With a focus on community and personalized service, Wayne Savings Community Bank offers a more traditional banking experience, emphasizing in-person interactions and longstanding community ties.

Relay vs. Wayne Savings Community Bank comparison chart

Features/Services | Wayne Savings Community Bank | Relay |

Open Account Online | ⛔️ | ✅ |

Online Banking | ✅ Web, Apple iOs and Android Mobile Apps | ✅Web, Apple iOs and Android Mobile Apps |

Monthly Account Fees | $0-$15 | $0 |

Minimum Opening Deposit | $50-$100 | None |

Minimum Balance Requirement | Not specified | None |

Overdraft Fees | $35 | $0 |

Money Movement | Insert fees here Wire Transfer: $20-$50 ACH Payments: $0.25 | Wire Transfer: $5 domestic, $10 international (Free with Relay Pro) ACH Payments: Free |

ATM Access | 11 | 55,000+ |

Branch Locations | 11 | Online-only |

Interest-bearing accounts | ✅Varies by account | ✅1-3% APY on savings depending on balance |

Business Credit Cards | ✅ | ⛔️ |

Online Reviews | CANNOT FIND ANYWHERE |

Profit-first banking

Relay

Relay is uniquely tailored for businesses that prioritize the Profit First methodology. With Relay, businesses can set up to 20 real checking accounts, not just virtual envelopes, all without any account fees or minimum balance requirements. Each of these accounts can be given a distinct nickname, such as Income, Profit, Owner’s Pay, Taxes, or Operating Expenses, streamlining financial organization.

Relay offers percent-based transfers between checking accounts and auto-transfer rules, enabling businesses to automate their Profit First allocations on various schedules, whether daily, weekly, twice-monthly, or monthly. The platform's secure collaboration features also make it easy for businesses to receive guidance from a Certified Profit First Professional directly within Relay.

Wayne Savings Community Bank

Wayne Savings Community Bank adheres to a more traditional banking structure. While they do offer multiple bank accounts for businesses, each comes with its own set of account fees. This setup can pose challenges for businesses aiming to implement the Profit First approach, as they would face additional costs for every separate account they establish.

Wayne Savings Community Bank's model is more aligned with businesses that lean towards a conventional banking framework, rather than those keen on adopting a Profit First strategy.

Online banking

Relay

Relay's approach to online banking is centered around providing businesses with a seamless, digital-first experience. The platform is designed to cater to the modern business owner who values convenience, efficiency, and integration.

With Relay, businesses can manage multiple checking accounts, initiate transfers, and integrate with popular accounting tools like QuickBooks Online, Xero, and Gusto. The intuitive interface, combined with robust mobile and web applications, ensures that businesses can handle their financial tasks anytime, anywhere, without the need for branch visits.

Wayne Savings Community Bank

On the other hand, Wayne Savings Community Bank offers a more traditional online banking experience, rooted in its community banking ethos. While they provide essential online banking services, allowing businesses to view account balances, transfer funds, and pay bills, their platform might not be as feature-rich as newer, digital-first platforms.

However, for businesses that value a blend of traditional banking with some online capabilities, Wayne Savings Community Bank offers a reliable solution. Their online services are complemented by their mobile banking app, ensuring businesses in Ohio have the tools they need to manage their finances on the go.

Customer service

Relay

Relay understands the importance of prompt and efficient customer support for businesses. They offer a robust customer service experience with 24/7 support through various channels. Whether it's through their online chat, email, or phone support, businesses can expect timely responses to their queries. Relay's emphasis on digital-first solutions ensures that businesses can get the assistance they need, whenever they need it, without the traditional delays or limitations of conventional banking.

Wayne Savings Community Bank

Wayne Savings Community Bank, rooted in its community banking tradition, offers a more personalized touch when it comes to customer service. Businesses can reach out to the bank through phone, email, or by visiting one of their 11 branch locations in Ohio. This face-to-face interaction can be invaluable for businesses that prefer a more hands-on approach to their banking needs. The bank's commitment to serving its local community is evident in its approach to customer service, ensuring that businesses feel valued and understood.

Verdict: Which banking partner is right for your business?

Choosing the right banking partner is crucial for the success and growth of your business. Both Relay and Wayne Savings Community Bank offer unique features tailored to support business needs.

While Relay provides a digital-first approach with seamless integrations and no monthly fees, Wayne Savings Community Bank is highly specialized in the Wooster area.

To find the right fit for your business, consider your goals and the type of support you need. Then, choose the banking platform that aligns with your business plan. And if you're ready to sign up for Relay, you can !

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more