Looking for a business bank in Florida? In this guide, we compare Relay, an online banking platform, and Wauchula State Bank (now Crews Bank & Trust), a traditional bank.

Traditional banks, like Crews Bank & Trust, offer a blend of in-person and online services, and modern platforms, like Relay, provide a fully digital banking experience tailored for businesses. Let's delve deeper into what each institution brings to the table.

In this blog:

What is Relay?

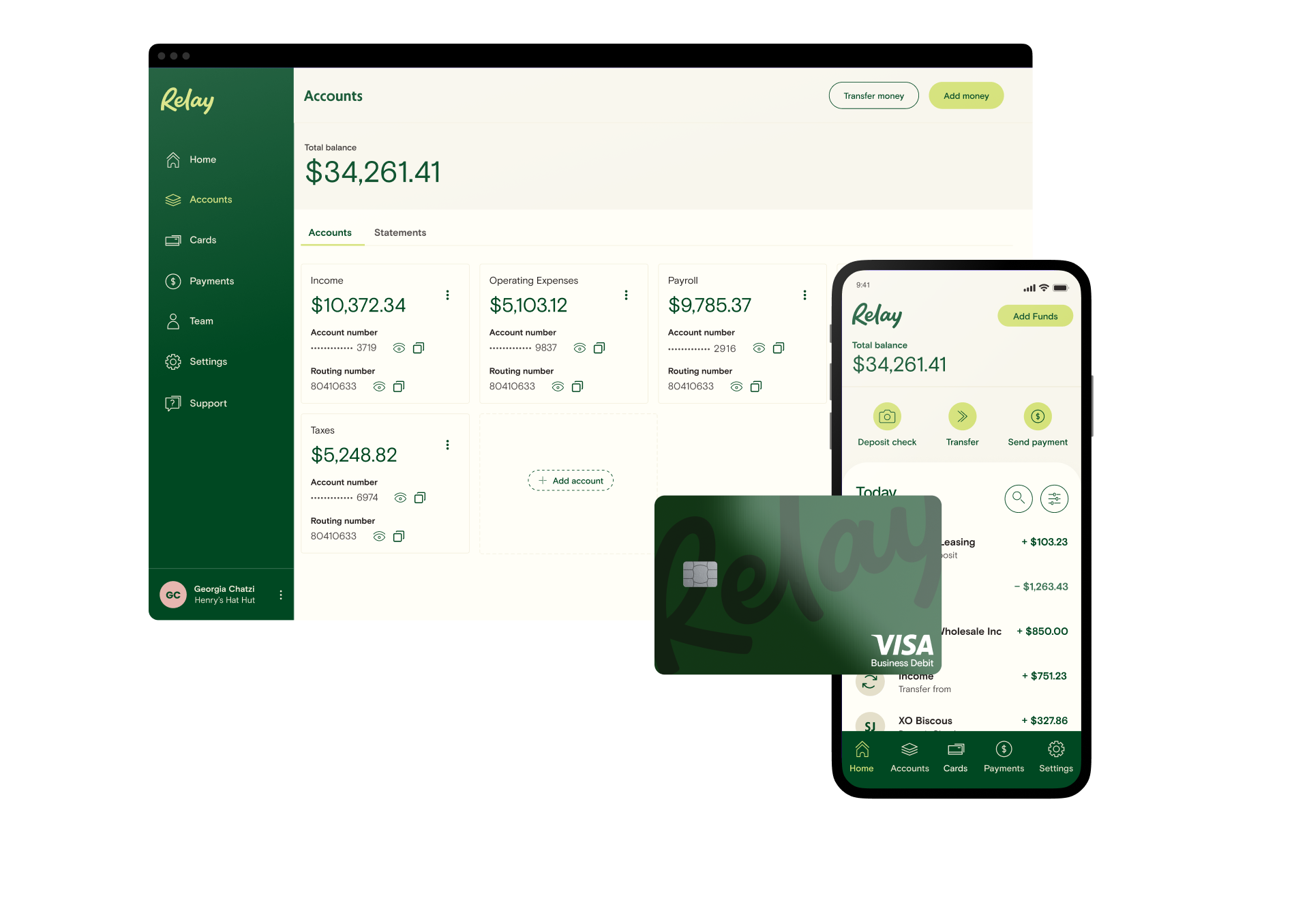

Relay is more than just a banking platform—we’re a partner in the success of your small business. Designed to provide clarity and control over your finances, Relay offers up to 20 free business checking accounts, 50 physical or virtual Visa® debit cards, and a full suite of features aimed at simplifying money management.

With no hidden fees, transparent pricing, and integrations with popular accounting tools, Relay is a great choice for businesses seeking financial clarity and growth.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWhat is Wauchula State Bank?

Established in 1929, Wauchula State Bank started as a family-owned community bank. As of today, the bank has unified with Crews Bank & Trust and Charlotte State Bank to expand and serve more customers. It’s now known as Crews Bank and is a member FDIC bank. The bank offers business and personal banking, along with other financial services like credit cards and loans.

Crews Bank, formerly Wauchula State Bank, has 21 branch locations across central Florida, in communities including Wauchula, Lakeland, Lake Placid, Sebring, and Hardee County.

Relay vs. Wauchula State Bank comparison chart

Features/Services | Crews Bank & Trust | Relay |

Open Account Online | ⛔️ | ✅ |

Online Banking | ✅ Web, Apple iOs and Android Mobile Apps | ✅Web, Apple iOs and Android Mobile Apps |

Monthly Account Fees | $3-$15 | $0 |

Minimum Opening Deposit | $0 | None |

Minimum Balance Requirement | $0-$5,000 | None |

Overdraft Fees | $33 | $0 |

Money Movement | Wire Transfer: $15-$50 ACH Payments: Not specified | Wire Transfer: $5 domestic, $10 international (Free with Relay Pro) ACH Payments: Free |

ATM Access | 50,000+ | 55,000+ |

Branch Locations | 21 | Online-only |

Interest-bearing accounts | ✅Varies by account | ✅1-3% APY on savings depending on balance |

Business Credit Cards | ✅ | ⛔️ |

Online Reviews |

Multiple checking accounts

When you bank with Relay, you can open up to 20 free business checking accounts which you can access from one platform. That way, you don’t have to lump your operating expenses, payroll, and emergency funds all together in one account. Plus, if your business follows the Profit First method, you’ll need to have multiple accounts to manage your funds.

With Crews Bank & Trust, you’ll have to pay fees on every additional account that you open, and your accounts will be separated in your online banking. The bank doesn’t offer the same auto-transfer rules to automatically divide your money across accounts, so it’ll be harder to achieve Profit First if this is your goal. It does offer a business savings account.

Wire transfer options and incidental fees

Relay offers transparent pricing for wire transfers, with a $5 fee for domestic wires and a $10 fee for international transfers. Crews Bank charges $15 for incoming domestic and foreign wires, $25 for outgoing domestic wires, and $50 for outgoing foreign wires. If you complete your wire transfers via online banking, however, those fees drop to $15 for outgoing domestic wires and $40 for outgoing foreign wires.

Online banking and account opening

As an online banking platform, you can open your Relay account entirely online in about 10 minutes. All of our banking services are accessible from your online account via desktop or mobile.

Crews Bank & Trust, a traditional brick-and-mortar bank, also has an online platform and mobile banking where you can perform some of your banking. You cannot open a new account online. For other services, you’ll have to visit a branch location and speak to someone in person.

Verdict: Which banking partner is right for your business?

Choosing the right banking partner is crucial for the success and growth of your business. Both Relay and Wauchula State Bank offer unique features tailored to support business needs.

Relay provides a digital-first approach with seamless integrations and no monthly fees Wauchula State Bank, now known as Crews Bank & Trust, provides much of Florida with in-person services for those who prefer to bank this way. To find the right fit for your business, consider your goals and the type of support you need. Then, choose the banking platform that aligns with your business plan. And if you're ready to sign up for Relay, you can !

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more