There are a ton of choices when it comes to selecting the best bank for your business in Georgia. Businesses may find themselves overwhelmed, comparing features, fees, and customer service to determine the best fit.

In this article, we'll be comparing Metro City Bank, a Georgia-based bank with a traditional approach, to Relay, our modern online banking platform designed specifically for businesses.

In this article:

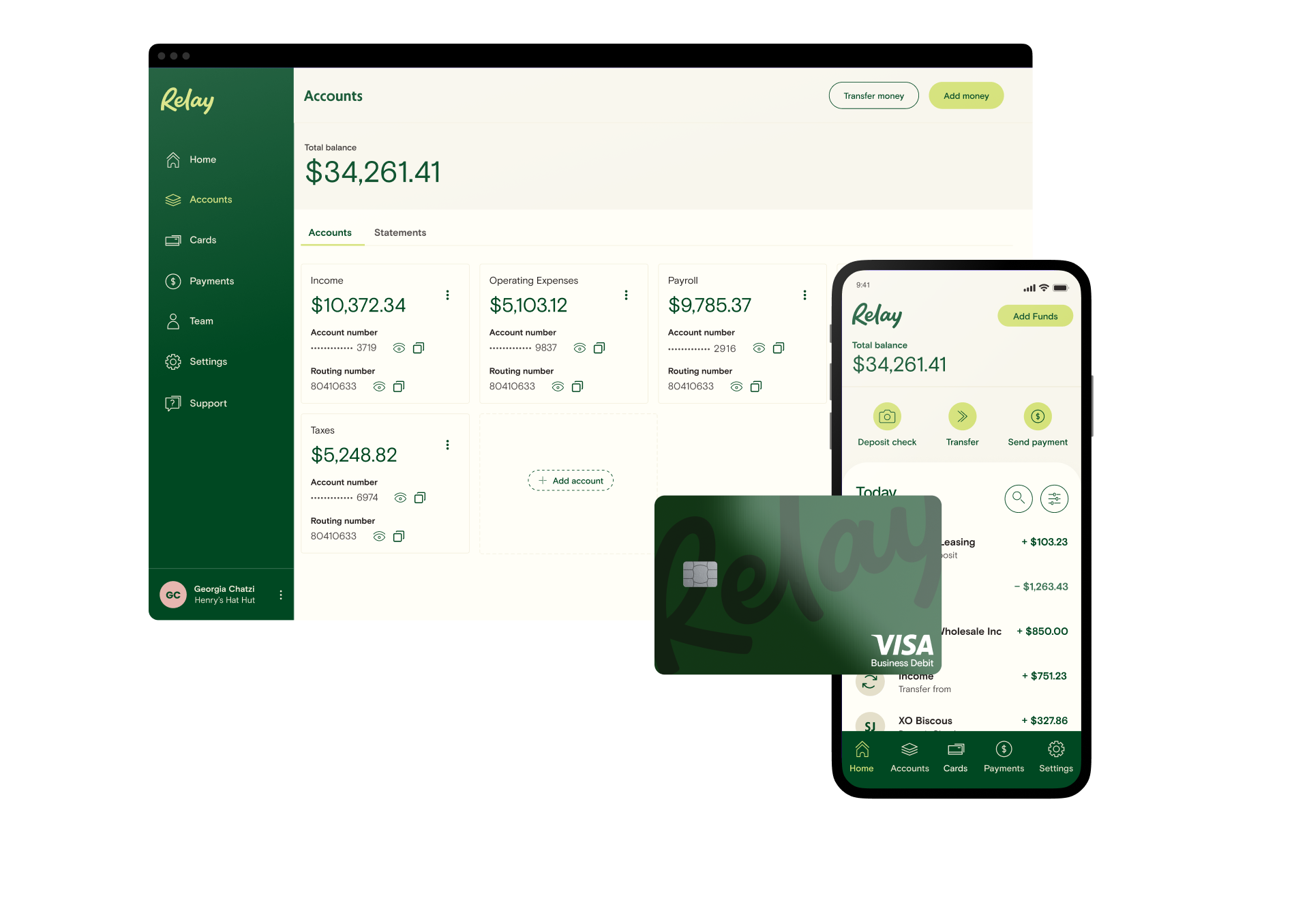

What is Relay?

Relay is an online banking solution built with small businesses in mind. We understand the unique challenges businesses face. That’s why we offer powerful money management features including:

Up to twenty free business checking accounts

Seamless integration with popular accounting tools

A dedicated customer experience team is available through chat, email, and phone.

No monthly fees

No minimum balance requirements

An extensive network of fee-free ATMs

Relay is designed to simplify and enhance the banking experience for businesses.

What is Metro City Bank?

Metro City Bank, headquartered in Georgia, offers a range of banking services tailored to both individuals and businesses. They offer in-person support at their thirteen branch locations across the Greater Atlanta and Montgomery areas. They also offer phone and email assistance.

Their business checking account is designed for businesses seeking a basic banking solution. Their accounts have a monthly maintenance fee which can be waived by maintaining an average daily balance.

MCB also provides mobile banking, allowing businesses to manage their finances on the go.

Relay vs. Metro City Bank comparison chart

Features/Services | Metro City Bank | Relay |

Open Account Online | ⛔️ | ✅ |

Online Banking | ✅ Web, Apple iOs and Android Mobile Apps | ✅ Web, Apple iOs and Android Mobile Apps |

Monthly Account Fees | $10 | $0 |

Minimum Opening Deposit | Varies by account | None |

Minimum Balance Requirement | Varies by account | None |

Overdraft Fees | $0 | $0 |

Money Movement | Insert fees here Wire Transfer: $10 - $25 Domestic, $25 - $45 International ACH Payments: Free | Wire Transfer: $5 domestic, $10 international (Free with Relay Pro) ACH Payments: Free |

ATM Access | 13 | 55,000+ |

Branch Locations | 13 | Online-only |

Interest-bearing accounts | ✅ Varies by account | ✅ 1-3% APY on savings depending on balance |

Business Credit Cards | ⛔️ | ⛔️ |

Online Reviews |

Online banking

Having an adaptable online banking partner is crucial for businesses on the go. Metro City Bank offers online banking, allowing businesses to manage their finances without the need to visit a branch. Online services include viewing account balances, transferring funds, and more.

Relay takes online banking a step further. Our platform is designed to be intuitive and user-friendly, with features that cater specifically to businesses.

Customize your dashboard

Set up automated transfers based on percentages

Integrate with accounting tools like QuickBooks, Xero, and Gusto

Relay ensures that businesses have all the tools they need at their fingertips.

Customer Support

Having reliable customer support can make all the difference for your banking.

Metro City Bank offers support through traditional channels: phone, in-person at their branches, and email. Their approach ensures businesses can get the assistance they need from a local representative who understands their needs.

Relay has comprehensive customer support. Our dedicated Customer Experience team provides multi-channel support, including chat, email, and phone, so businesses can reach out in a way most convenient for them.

Our team is trained to help businesses leverage Relay’s features to their fullest potential. This commitment to customer service is reflected in our 4.5-star Trustpilot rating, backed by over 550 reviews.

Fees and Account Management

Metro City Bank's business checking account comes with a monthly maintenance fee of $10. This fee can be waived if businesses maintain an average daily balance for the month, which varies by account. The minimum deposit required to open an account depends on the account type.

Relay offers a fee-free banking experience. Additionally, Relay offers up to twenty checking accounts without any account fees, allowing businesses to organize their finances efficiently without worrying about added costs.

Relay vs. Metro City Bank: Which is best for your business?

While Metro City Bank offers a traditional banking experience with a local touch, Relay provides a modern, online banking solution specifically for businesses.

From fee-free banking and customer support to advanced online banking, Relay is designed to prioritize your business. Relay’s features, fees, and support make this online bank the best fit for your business needs.

Ready to change the way that you bank? Sign up for a Relay account today to get started.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more