Looking for a business bank in Florida? In this guide, we compare Relay, an online banking platform, and American Momentum Bank, a traditional bank. Traditional banks, like American Momentum Bank, offer a blend of in-person and online services, and modern platforms, like Relay, provide a fully digital banking experience tailored for businesses. Let's delve deeper into what each institution brings to the table.

Table of Contents

What is Relay?

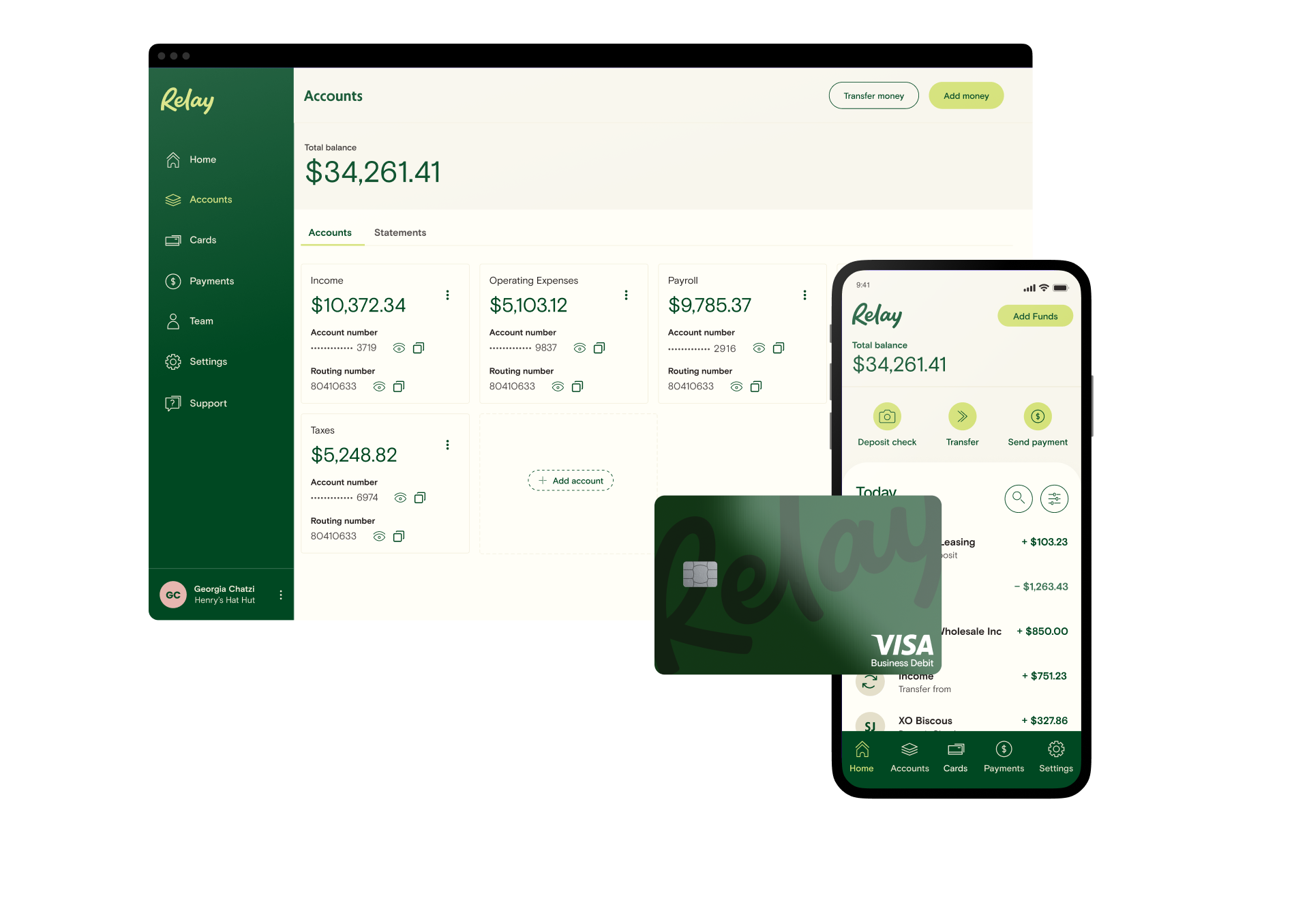

Relay is more than just a banking platform—it's a financial ally for small businesses. With a suite of tools designed to provide clarity and control over your finances, Relay is the go-to choice for businesses aiming for growth and stability.

With Relay you can open up to 20 checking accounts with seamless accounting integrations, ensuring you always have a clear view of your finances. With no hidden fees or complex pricing structures, Relay is a transparent and trustworthy partner in your business’s journey to success.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn moreWhat is American Momentum Bank?

Headquartered in College Station, Texas, American Momentum Bank began as a Texas community bank and has expanded to serve Texas and Florida communities. As a traditional bank, its branches offer a range of financial services for businesses and individuals. While it may not offer a modern, digital-first approach, American Momentum Bank prides itself on its strong community ties, personalized customer service, and a history of trust in the cities it serves.

American Momentum Bank has locations across Texas and central and south Florida. Its Texas locations include San Antonio, Odessa, Midland, and Devine. In Florida, some of its locations include Orlando, Tampa, Clearwater, Sarasota, Brazos, Winter Garden, and Naples.

Relay vs. American Momentum Bank comparison chart

Features/Services | American Momentum Bank | Relay |

Open Account Online | ⛔️ | ✅ |

Online Banking | ✅ Web, Apple iOs and Android Mobile Apps | ✅Web, Apple iOs and Android Mobile Apps |

Monthly Account Fees | $0-$15 | $0 |

Minimum Opening Deposit | $100 | None |

Minimum Balance Requirement | $0-$5,000 | None |

Overdraft Fees | Not specified | $0 |

Money Movement | Wire Transfer: Not specified ACH Payments: $.35 | Wire Transfer: $5 domestic, $10 international (Free with Relay Pro) ACH Payments: Free |

ATM Access | 55,000+ | 55,000+ |

Branch Locations | 11 in Florida | Online-only |

Interest-bearing accounts | ✅Varies by account | ✅1-3% APY on savings depending on balance |

Business Credit Cards | ⛔️ | ⛔️ |

Online Reviews |

Multiple checking accounts

When it comes to managing your company’s finances, having multiple checking accounts can be a game-changer. Relay offers up to 20 individual checking accounts, allowing your business to earmark funds for specific purposes, like payroll, taxes, or operational expenses. This granularity provides clarity and offers you better financial management.

American Momentum Bank offers different types of business checking accounts, with options for businesses with smaller and larger transaction volumes. While you have the freedom to choose the best account for your business, you’ll have to open separate accounts with different fee systems if you want to make use of multiple accounts for your one business.

American Momentum Bank does offer quite a few business and commercial lending products as well, including SBA lending, real estate lending and equipment loans.

Online banking and opening an account

As a digital-first banking platform, all of Relay’s services are accessible online. From signing up to managing accounts, everything can be done from home, offering your business flexibility and convenience. Opening an account only takes about ten minutes, and account services that have traditionally required an in-person branch visit can be done right from your phone or desktop.

At American Momentum Bank, in-person services offer a super personal touch, but it can be more difficult to open an account online. To open an account, you'll have to call or visit a branch; otherwise, you can fill out a form online and they’ll give you a call.

Once you’re signed up, American Momentum does offer online banking, so you can perform most banking services that don’t require a branch visit from your online account.

Customer support and accessibility

Relay’s Customer Experience team is available 7 days a week. When you submit a request online, someone on our team will usually get back to you within a couple of hours. Or, you can call directly between 9 am to 5 pm ET, Monday to Friday. We’ve been rated 4.6 stars on Trustpilot, with many customers citing our great customer service. If support is especially important to you, take a look at our reviews to see what other businesses who use Relay have to say.

American Momentum Bank has a contact form on its website where you can submit requests for help. Their website also lists a toll-free phone number and an option to request help via email. Being a brick-and-mortar bank, you can also visit your local branch to seek in-person support.

Verdict: Which banking partner is right for your business?

Choosing the right banking partner is crucial for the success and growth of your business. Both Relay and American Momentum Bank offer unique features tailored to support business needs.

While Relay provides a digital-first approach with seamless integrations and no monthly fees, American Momentum Bank provides in-person services for those who need local specialization across Florida. To find the right fit for your business, consider your goals and the type of support you need. Then, choose the banking platform that aligns with your business plan. And if you're ready to sign up for Relay, you can !

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more