What do real estate investors need to focus on to keep profit in their pockets come tax time? In Episode #4 of On the Money Mondays, we’re joined by Thomas Castelli, a CPA who specializes in accounting for the real estate industry. Castelli offers strategies for major tax savings — and points out business accounting pitfalls for investors to avoid.

Subscribe for future episodes: https://relayfi.com/mondays

Our guest, Thomas Castelli, CPA, is a certified financial planner with Hall CPA — an accounting firm that exclusively works with real estate investors across the United States. They assist in tax preparation, tax planning, as well as accounting and CFO services. For more real estate accounting content, follow him on Instagram @thomascastellicpa.

In this article

On the Money Mondays, Episode #4

Below is a revised transcript of the above video:

Four common (and expensive) mistakes real estate investors can make

The real estate business requires diligent bookkeeping and specialized financial reporting — during tax season and year-round. To save on your tax bill, our CPA expert advises that investors should avoid making these common mistakes:

1. Not working with a real estate tax specialist

The biggest error a real estate investor often makes, says Thomas, is that they're not working with a real estate tax or accounting specialist. Instead, he explains, they're working with a tax generalist. Real estate is one of the most complicated areas of the tax code and tax generalists typically do a lot of work across a broad area instead of really drilling down into the details of real estate investment tax.

A generalist can end up costing their clients money in lost tax savings or missed opportunities because they're not aware of all the tax-saving options available.

2. Failing to keep precise records

Investors don't always keep sufficient books and records. Thomas uses an example of an investor working with a property manager. The property manager has property management level financial statements which might not be in the format an investor will need to make good financial decisions for their business or for taxes.

A tremendous amount of work has to go into cleaning that all up in order to file with the IRS. Thomas recommends staying on top of records all year long to avoid the annual tax season headache.

3. Not collecting enough documentation

Document everything: the mileage driven for business, the meals with business associates, the travel you do for work. Keep those records organized. Documentation, says Thomas, is absolutely critical in any business, but especially in real estate when you're dealing with complex tax strategies.

For real estate investors, tax deductions can be applied to a long list of expenses. The concept of de minimis safe harbor allows you to expense almost anything with an invoice line item of $2,500 or less and avoid paying depreciation recapture costs. So hang on to those invoices and receipts!

4. Not seeking advice on how to minimize a tax bill

Many investors never receive tax planning or tax advice — whether that’s from their CPA or financial planner — on what they can do to actually minimize their taxes.

There's a difference between tax preparation (someone filing your tax returns for you) and tax strategy and planning. The latter entails someone sitting down with you and looking at your situation saying, "Okay, well here's where you are today. Here's where you're looking to go. Here are the moves you can make, the strategies that you can implement that's actually going to help reduce your taxes when it comes time to file the return."

Smart strategies for minimizing real estate investment tax

Whether real estate investing is your full-time gig or a growing side hustle, there are several things you can do to shrink your tax bill.

Apply for real estate professional status

This is one of the most coveted tax statuses in the entire tax code because it allows long-term rental investors to take losses from their rental properties and use them to offset their active income (think: income from a job or another active business you may be running).

Make use of cost segregation

A cost segregation study is when someone breaks down the various components of a property and allows you to accelerate your depreciation expense, which is a non-cash expense that reduces income for tax purposes, but not your cash flow.

In other words, the money doesn't actually leave your pocket, it's only on paper. This can create a big tax loss for you that you're able to use against your other income.

Take advantage of the short-term rental exception

Under the Tax Reform Act of 1986, all rental activities were made passive by default. However, if you have a rental property with an average stay of seven days or less, it's not considered a "rental activity." It's just considered a normal business so it's not passive by default. If you get actively involved, the losses from your short-term rental property can be non-passive and offset your other income.

Bonus: When you combine that with a cost segregation study, says Thomas, it becomes just as powerful as the real estate professional status.

Why short-term rentals are popular with real estate investors

The real estate professional status applies mainly to long-term rental properties (a property that has an average stay of eight days or more). It helps investors use the losses from these long-term rental properties to offset or reduce the amount of income that they’re paying in other areas.

In order to qualify as a real estate professional, however, an investor needs to spend more than 750 hours in the real property trader business and more than half their total working time. That last piece, says Thomas, often deters people and prevents them from qualifying as a real estate professional.

That's why short-term rentals have become so popular. If your short-term rental has an average stay of seven days or less, it is excepted from the definition of rental activity. You don't need to qualify as a real estate professional in order to use the losses from your short-term rental to reduce the amount of tax you pay on your active sources of income, such as income from a job or another business. All you have to do is materially participate in your short-term rental.

This can be done by meeting a list of legal requirements. Here are three to prioritize:

You do everything yourself. All the work that goes into running the property is done by you.

You spend more than a hundred hours on your short-term rental property and no one else spends more time than you.

You spend more than 500 hours on your short-term rental.

Show me the money: real world examples of tax savings

Here’s what the math looks like when you combine the real estate professional status or the short-term rental loophole with cost segregation studies and bonus depreciation:

Example 1: You have a $500,000 property and you’re in the 24% tax bracket

Suppose you were able to use a cost segregation study on this property. In that case, you could generally expect somewhere between 20 to 30% of that to be reallocated to 5, 7, and 15-year property, which is eligible for 100% bonus depreciation.

You are able to take this $120,000 loss as non-passive against your W-2 or your active business income because you qualify as a real estate professional or you use the short-term rental loophole. This $120,000 expense would be worth $28,800 if you were in the 24% tax bracket.

Example 2: You have a $500,000 property and you’re in the 37% tax bracket

Let's say you're at the top tax bracket, 37%. Then this same $120,000 expense at the 37% tax bracket will be worth $44,400 in tax savings.

Savings like this can have a meaningful impact on your business. $44,000 is a new car to ease all the work-related travel you do. It’s a downpayment on your next property. It’s a salary for an assistant to help manage your expanding real estate portfolio. It’s money you can put back into your business to continue to grow.

Additional Resources from Thomas

🏡 Learn more about Hall CPA on their website

📕 Download their short-term rental tax guide

💲 Join the Tax Smart Investor's Facebook Group

🎧 Listen to Real Estate CPA Podcast

▶️ Subscribe to the Real Estate CPA on Youtube

🤳🏻 Follow Thomas on Instagram

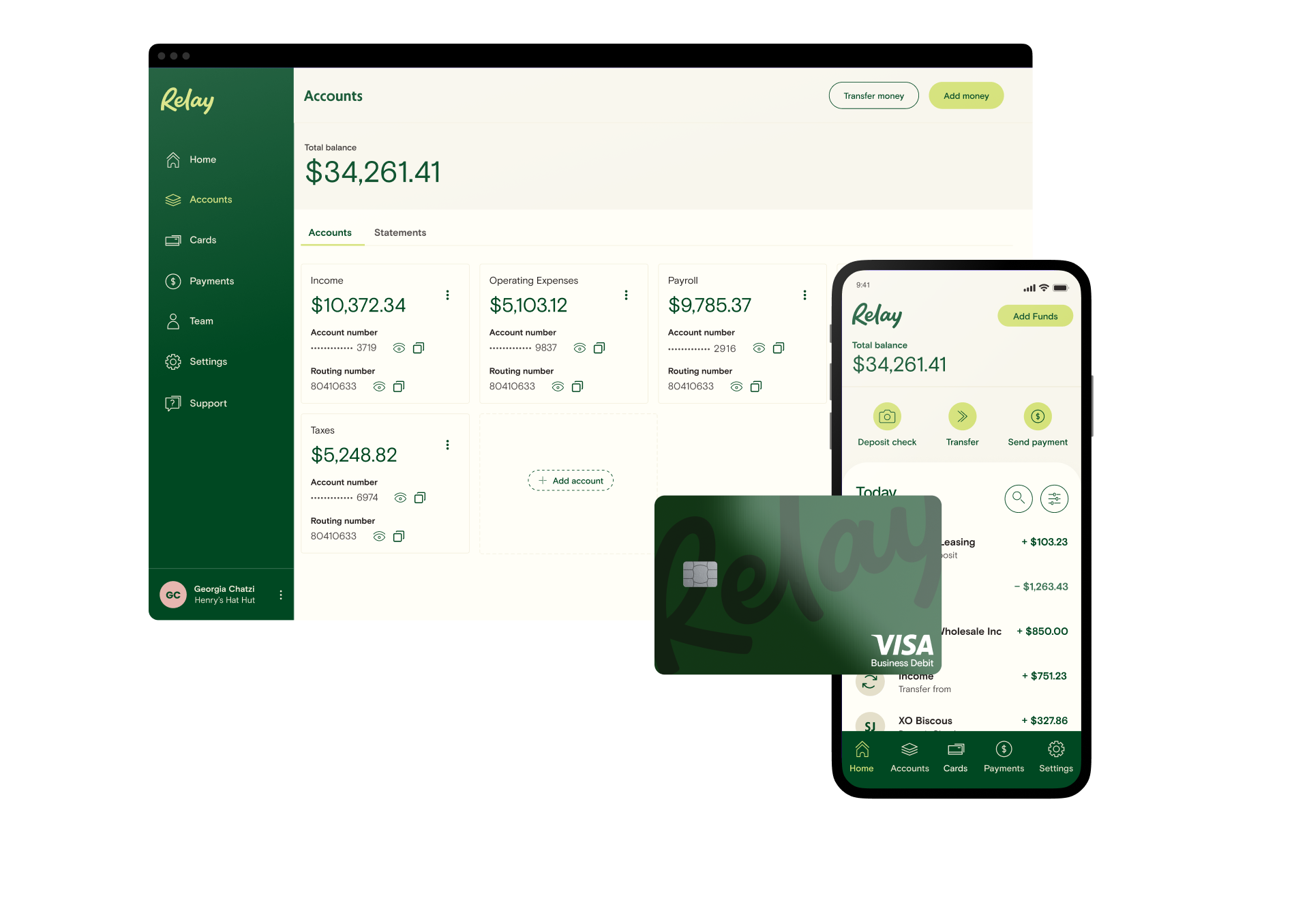

Bank with Relay for a stress-free tax season

With best in class accounting software integrations, Relay makes bookkeeping, expense tracking and reporting easier. To learn more about how small business banking with Relay can simplify your accounting process and make tax season less stressful, click here.

Banking Built for Business Owners

No account fees or minimums; 20 checking accounts; 2 savings accounts with 1.00%-3.00% APY; 50 virtual + physical debit cards. Open account 100% online.

Learn more