Today’s mobile technology 📲 puts all kinds of information at your fingertips — so it only makes sense that you’d be able to access your finances on your mobile device as well. Mobile banking provides a vast upgrade to the digital services of traditional banks, but many are still slow to adapt, wondering about the benefits of digital business banking.

Maybe digital banking is new to you, maybe you're trying to choose a new business bank, or maybe you're just on the fence about banking apps. In this article, we'll take a look at why mobile banking should be a non-negotiable — even if you're running an "old school" business. First, let’s take a look at what mobile business banking is.

In this article:

📱 What is mobile business banking?

Mobile business banking is a bank account you can access from your mobile device. You can access a mobile business bank account anywhere you have phone service, which can be used by downloading a mobile banking app via the app store or opening a web browser on your Android or Apple iOS devices.

While both traditional banks and neobanks may offer mobile banking, neobanks offer much more advanced digital features. Traditional banks only offer simple mobile banking features like viewing your account information and making simple wire transfers.

Dedicated mobile business banks, also called online banks and neobanks, operate completely online without the need for a physical location. They are designed to be used digitally, which comes with a lot of benefits in terms of accessibility, features and ease of use.

Why is mobile business banking important?

Mobile business banking became popular in the late 20th and early 21st centuries. Since their advent, digital banks have transformed to offer so much more than just on-the-go convenience.

Mobile banking allows business owners to manage their finances from anywhere in the world, with powerful tools that enable you to see your cash flow like never before. This technology gives business owners a crystal-clear picture to understand precisely what they’re earning, spending and saving to make the most intelligent decisions for their business.

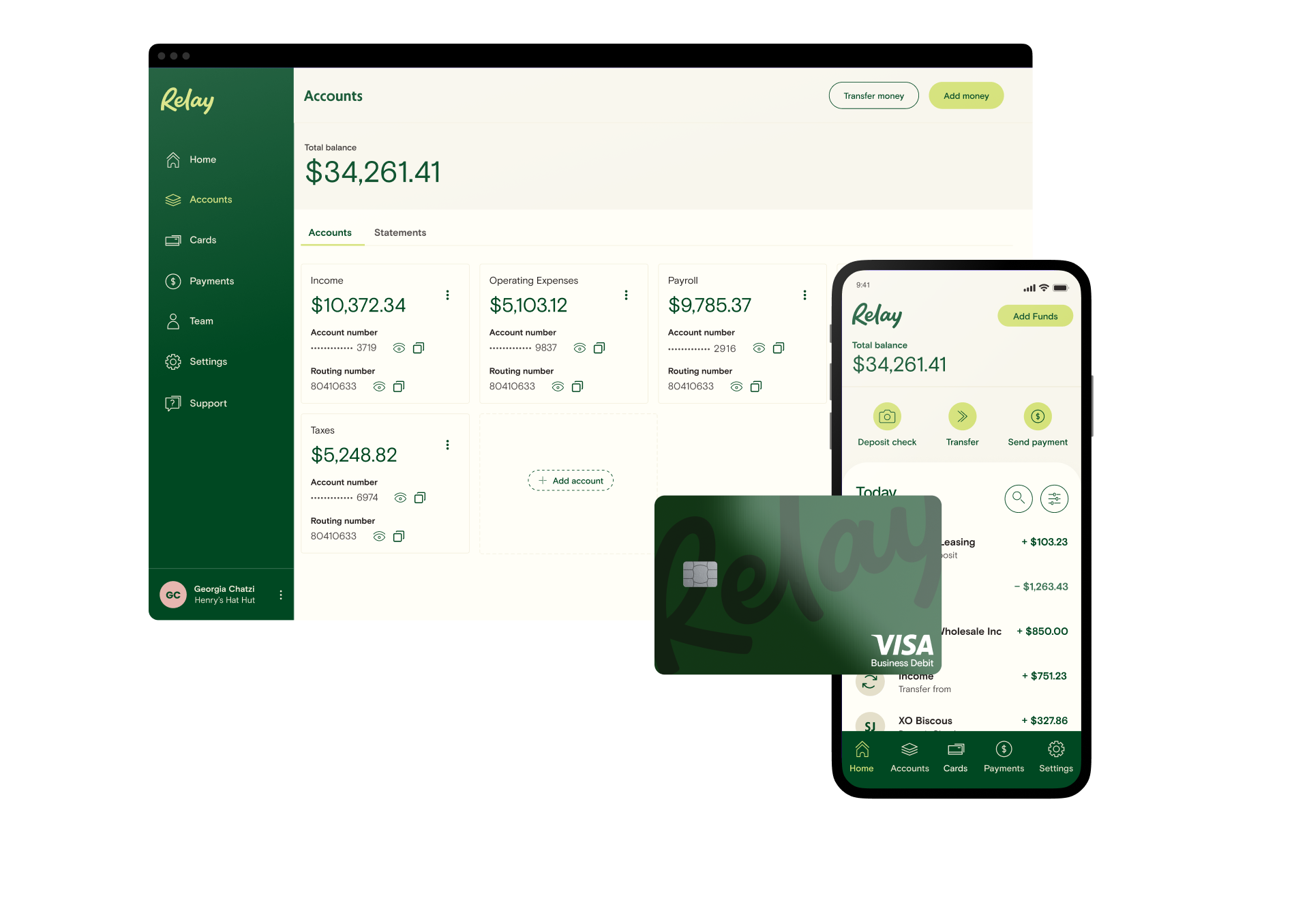

In addition to the suite of digital tools, mobile business banks tend to offer lower maintenance fees. Relay, for example, gives you get 🏦 20 free checking accounts, 💳 50 physical and virtual debit cards, as well as 🔄 integrations with essential business tools like Xero, QuickBooks Online and Gusto. This comes without enrollment fees, account fees, overdraft fees, or minimum balance requirements.

Benefits of mobile business banking

Mobile business banking comes with a variety of benefits, including 24/7 access, better security, spending insights and payments at your fingertips. All of this help you better manage cash flow inside your business. Let’s look at the top benefits of using a mobile business bank account.

⏰ 24/7 access

Gone are the days when you need to visit a physical branch location to manage your finances. Today, mobile banking gives business owners access to their funds 24/7 from anywhere in the world. What does this mean for you?

24/7 bank access means you don’t have to wait around to transfer funds, categorize your expenses or make payments. This means greater financial efficiency for you and your team. Plus, with a bank like Relay, you get access to knowledgeable support specialists dedicated to understanding what you need to achieve your goals.

📊 Spending insights

Mobile banking has given way to more powerful online banking tools. Understanding when and how transactions flow in your business — all from your smartphone app — can give you a sense of security and confidence about your business. Digital banking also comes with features like enriched data (so you don’t have to waste time decoding purchases).

Having transaction history insights at your fingertips can make budgeting and making decisions quickly a whole lot easier.

📩 Mobile deposits

Mobile check deposits make it easy to deposit funds on the go without visiting an ATM or bank branch. All you have to do is snap a picture of the check via your bank’s mobile app and it will be imported into your business checking account.

Many mobile bank accounts also allow you to store check images and memos for easy bookkeeping so you can keep vendor information in one place.

💳 On-the-go payments

Mobile payments have come a long way in recent years. Now, online banks offer comprehensive features like automatic bill payments using multip-step approval workflows to ensure bills get paid on time using digital debit cards.

With a banking platform like Relay, you can also pay bills using ACH, domestic and international wires and checks, seamlessly collect payment data and automatically sync unpaid bills using account integrations such as Quickbooks Online or Xero.

💸 Cash flow clarity

A mobile business account allows you to collect income in one place so you can see exactly what you’re working with. A crystal-clear picture of your cash flow makes it easy to understand what you’re earning, spending and saving so you can make the smartest decisions for your business.

With Relay, you get 20 free checking accounts so you can automate transfers from one to multiple checking accounts using dollar amounts or percentages. This allows you to categorize your cash flow using multiple bank account budgeting.

The pros and cons of mobile banking

When considering if a mobile business bank is right for you, weighing the pros and cons can help you make the right decision. Mobile banking gives you access to a power suite of tools at your fingertips 24/7, but the lack of physical branches could be a disadvantage to some small business owners.

Pros of mobile business banking: 👍

Take better control of your cash: With a smarter money management platform like mobile banking, you get access to ultra-detailed banking data at your fingertips.

Get better support: Get financial support without visiting a branch. Support specialists can help you achieve your goals via email, chat and phone.

Make on-the-go payments: With online banking, you can transfer funds and make deposits on-the-go with multi-step approval workflows.

See your spending habits: With auto-categorization and comprehensive data, you can organize your cash flow and expenses using separate checking accounts for greater clarity and budgeting control.

Keep your money safe: Most mobile banks are member FDIC insured up to $250,000, so you can be confident that your money is protected.

Cons of mobile business banking: 👎

No physical branch: While virtual support is an advantage for most busy business owners, some prefer in-person banking support. This makes mobile banking less than ideal for those who prefer the traditional banking method.

Requires you to learn how to use the mobile banking features: For those that are new to mobile business banking, it can be challenging to learn how to use the online features that are offered. This can result in frustration without the right support.

Is mobile business banking safe?

While mobile and online banks provide a vast upgrade to the digital banking services of traditional banks, some wonder if mobile banking is safe. 🧐

Yes, mobile banking is safe. This is because online banks understand security concerns and have measures in place to protect their customers. Most neobanks offer safety standards like fraud detection, two-factor authentication, liability protection and automated security notifications via text message.

As a mobile bank account holder, you also play a key role in making sure you have security policies in place. Along with choosing a secure online bank, you can also employ your own measures like using strong passwords and avoiding public Wi-Fi. In addition, choose a mobile bank that is FDIC insured* so you can be confident that your money is protected. 💰

*Relay provides FDIC insurance via Thread Bank.

Bank with Relay

If you’re looking for mobile business banking, we think you'll love banking at Relay. Relay is truly built for business owners who want to get on the money and make smarter decisions in their business. Relay's platform has no account fees, no overdraft fees, and no minimum balance requirements.

https://www.youtube.com/embed/6WPlGbIbjrQ

Applying for a Relay account takes minutes — and you can sign up here today!