When embarking on your real estate investment journey, one of the first things you’ll need to set up is a business bank account.

If you’re researching the best business bank accounts for real estate investors, then you’ve come to the right place. In case you haven’t heard about Relay, we’re a business banking and money management platform that helps business owners, including property owners, stay on the money. So, we’ve compiled this short list of the best banks that will enable you to build financially healthy real estate portfolios.

What should real estate investors look for in a bank account?

With over 4,000 FDIC-insured commercial banks in the United States alone, there are a lot of financial institutions to choose from. But not all banks are built equal, and as a real estate investor, there are some banking features that you’ll want at your disposal.

Here are some factors that property investors should consider when choosing a bank for their investment property:

Account fees and minimum balances. The best banks will allow you to open accounts at no cost and with no monthly maintenance or minimum fees. Some may even allow you to open multiple checking and savings accounts, all without account fees or minimum balances.

Separation of funds. When running a real estate business, it’s important to know where your funds are coming from and to ensure that they are being used properly. Multiple checking accounts help to create a separation of funds and prevent money from being used for unintended purposes.

Ease of money movement. In order to run a real estate business, you’ll need the ability to move money in and out or between accounts efficiently with ACH payments, wires and check deposits at low costs.

Card services. Real estate investors spend a lot of money on home improvement and maintenance expenses for their properties, so you’re likely to want to have a few debit or credit cards in your wallet to help pay for these large expenses.

Financing options. Many investors will need to secure a loan to buy their first property. The best real estate banks offer loans with reasonable terms and great interest rates.

Customer service. Last but certainly not least, a good real estate business bank should have excellent customer service. Customer support should be helpful and responsive. It should be easy to open an account, and there should be plenty of ways to speak to a representative without having to physically go into a branch.

Now that we’ve laid out the factors, let’s dive into the shortlist. 👇

Relay

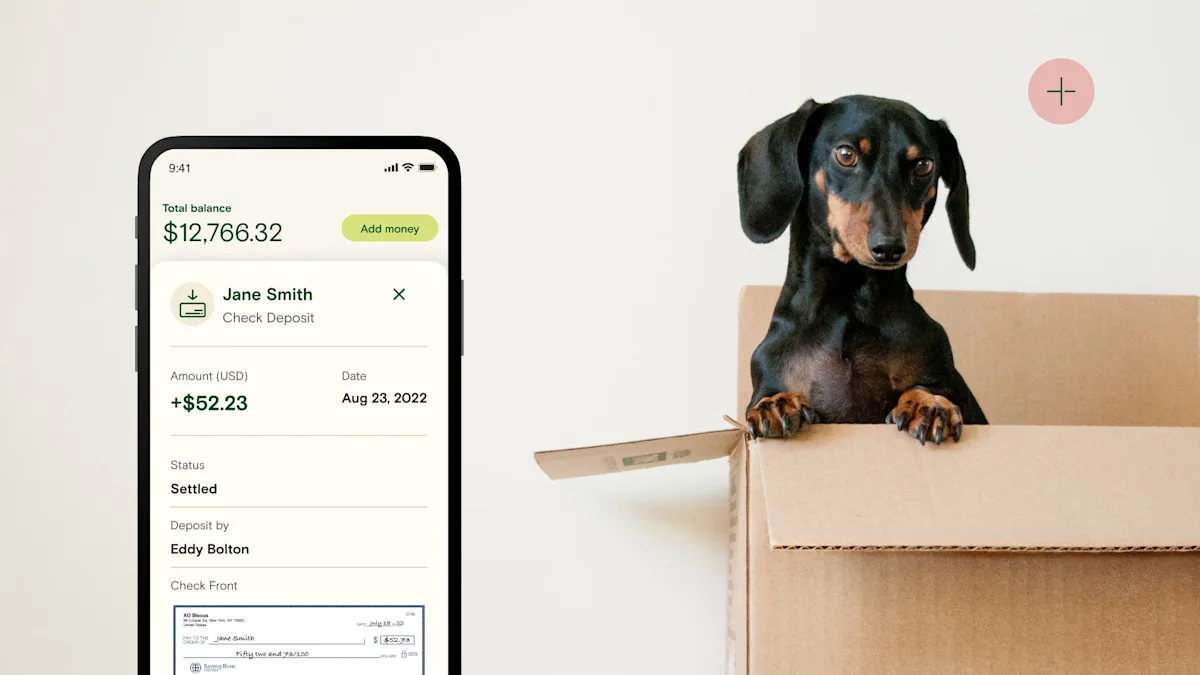

Whether you’re in the short- or long-term rental business, Relay’s online banking and money management platform will help you get crystal clear on what you’re earning, spending and saving.

Relay is a digital banking platform that offers banking services through Thread Bank, Members FDIC. Unlike traditional banks, Relay offers online banking with no account fees, minimum balances or overdraft fees.

https://www.youtube.com/embed/6WPlGbIbjrQ

With Relay, you can open up to 20 free, no-fee checking accounts to categorize your cash, and easily set aside cash reserves for ongoing costs like taxes, cleaning fees and property maintenance fees.

If you’re running a real estate business, especially a short-term rental, you probably experience high transaction volumes and need to make payments to vendors often. With Relay, you get unlimited payments and transactions with all your checking accounts. Send money via ACH, check or wire and receive payments via ACH, check deposit, wire and money apps like Venmo, Paypal and Stripe.

If you own multiple rental properties, Relay makes it easy to create checking accounts for each entity under one centralized login. This creates a clear separation of funds within your investment portfolio and allows you to make more accurate money decisions about the operations of each property. Not to mention, less stress come tax season.

Relay is also a great option for simple, easy collaboration with your team. You can avoid tons of back-and-forth by giving secure, read-only banking access to your property manager, lawyer, bookkeeper or anyone else who may need it.

Banking Feature | |

|---|---|

Account Fees | $0 |

Minimum Balances | $0 |

Checking Accounts | Up to 20 |

Saving Accounts | None |

Money Movement | • Unlimited transactions • Free ACH and check deposits • Domestic outgoing wires: $5 • International outgoing wires: $10 Or with Relay Pro for $30/month, you get: • Unlimited outgoing domestic and international wires • Same-day ACH transfers • Accounts payable automation |

Cards | Up to 50 free virtual or physical debit card Mastercards |

Financing | None available |

Customer Service | Dedicated customer service via email, chat or phone |

4.5/5 |

Verdict: Relay is best for managing cash flow

Relay is the perfect business banking platform for real estate investors that are super serious about taking control of their cash flow. If you’re looking for modern business banking for your real estate business, Relay’s multiple checking accounts, debit cards, and payment options make it an easy choice.

Ally Bank

Ally is an online bank that offers a number of checking, savings and retirement accounts for personal banking. Ally offers home loans and mortgage refinancing to help make the path to homeownership easier for investors and individuals. The entire application process is online and loan applications can be approved in as little as three minutes. If you're just starting out on your real estate journey and don't yet have an LLC set up for your business, Ally is a great online option.

Banking Feature | |

|---|---|

Account Fees | $0 |

Minimum Balances | $0 |

Checking Accounts | • One main checking account • Two sub-accounts where you can receive up to $2,500 per month in payments • Earn 1.5% interest on balances up to and including $100,000 |

Saving Accounts | Online savings account with up to 10 buckets and a 1.25% APY |

Money Movement | • Unlimited transactions • Free ACH and check deposits • Free incoming domestic and international wires • Domestic outgoing wires: $15 • International outgoing wires: $10 • Same-day ACH: $15 |

Cards | 1 physical debit card per business, which is linked to main checking account |

Financing | • Line of credit • Home mortgage loans • Mortgage refinancing |

Customer Service | 24/7 customer service via email or phone |

1.2/5 |

Verdict: Ally is best for personal mortgage loans

Ally offers a wide range of bank accounts and home loan tools for personal banking. They’re best suited for first-time investors who want to get approved fast, save on lender fees and are comfortable completing the entire loan process digitally.

Axos Bank

Axos Bank, one of America’s first digital banks, offers personal and business banking, borrowing, investing and planning services. They are members of the homeowners association (HOA) and specialize in real estate investment loans across a variety of rental properties including multifamily homes, single-family homes, condominiums, commercial properties and mixed-use buildings.

In particular, Axos provides bridge and construction loan options to owners, investors, and developers up to $75 million. Bridge loans, as the name suggests, are short-term loans that help to “bridge” a borrower over a short period of low cash flow. Construction loans help to finance the construction of the development.

Banking Feature | |

|---|---|

Account Fees | $0 |

Minimum Balances | • $0 for basic checking account • $5000 for interest checking account |

Checking Accounts | • One main checking account • Earn up to 1.01% APR with interest checking accounts |

Saving Accounts | Various high-interest savings accounts |

Money Movement | • Up to 100 free transactions • Free ACH and check deposits • Domestic outgoing wires: $35 • International outgoing wires: $45 |

Cards | 1 physical debit card per business, which is linked to main checking account |

Financing | • Small balance commercial real estate lending • Commercial real estate bridge loans and construction lending up to $75 million • Lender financing from $10 million to $100 million |

Customer Service | 24/7 customer service via email or phone |

1.4/5 |

Verdict: Axos is best the best online bank for large-scale commercial real estate loans

If you’re a large-scale commercial real estate investor, Axos offers a variety of banking and lending services for your needs. Take advantage of their treasury services for digital rent payment options.

PNC Bank

If you have a low credit score or are a first-time home buyer, finding financing for your real estate investment can be difficult. In this scenario, you may want to consider FHA or Federal Housing Administration backed loans. These loans are insured by the government and offer less stringent qualifying criteria with lower down payments. PNC Bank’s FHA loans offer down payments as low as 3.5%, with standard or adjustable rates and loan terms up to 30 years.

Banking Feature | |

|---|---|

Account Fees | $10, or free when you maintain $500 |

Minimum Balances | $100 |

Checking Accounts | 2 checking accounts in what they call a “Virtual Wallet” |

Saving Accounts | 1 savings account with competitive rates |

Money Movement | • Up to 150 transactions per month • Checks: $1.50 • Domestic outgoing wire: $25 via online banking • International outgoing wire: $40 via online banking • No ATM fees |

Cards | • 1 business debit card • Credit cards available |

Financing | Offers Mortage loans, refinancing and FHA loans |

Customer Service | Branch or online customer service via phone or email |

1.3/5 |

Verdict: PNC Bank is best for investors with below-average credit scores

PNC Bank is best for investors with low credit scores or first-time homebuyers looking to get their foot into the real estate market. Their FHA loans are a path to homeownership for many who would normally not qualify for a traditional bank loan.

Chase

JP Morgan Chase is the largest bank in the US, and Chase Bank is its consumer banking division. Like many other traditional banks, Chase has a large network of branches (more than 5,000) for in-person banking but a less-than-stellar reputation for customer service.

That being said, the positives of size are options, features and scalability. These include increased customer access to services including integrations for checking accounts, small business credit cards, various types of lines of credit, and commercial real estate loans.

Banking Feature | |

|---|---|

Account Fees | $15 monthly fee, $2000 minimum daily balance to waive |

Minimum Balances | Fees vary, can be as low as $2000 |

Checking Accounts | 1 checking account |

Saving Accounts | 1 savings account |

Money Movement | • Unlimited debit card purchases and ChaseATM transactions • ACH: $25 per month for up to 25 payments • Checks: $4 check fee • Domestic outgoing wires: $25 to $35 • International outgoing wires: $40 |

Cards | Debit cards and credit cards available |

Financing | Various financing options available, including lines of credit, small business loans and commercial real estate financing |

Customer Service | Branch or online customer service via phone or email |

1.8/5 |

Verdict: Chase is the best traditional bank for investment property loans

Chase is best for business owners who are looking for a traditional bank partner as they embark on their real estate journey. Their comprehensive business banking services and arguably the best reputation among the big banks.

U.S. Bank

U.S. Bank, also known formally as U.S. Bancorp, is the fifth largest bank in the United States. Although not as well-known as other large banks, it offers bank services like personal banking, business banking, wealth management and business loans. U.S. Bank’s business lending services include loans, lines of credit, financing for equipment or medical practices and short-term loans.

Banking Feature | |

|---|---|

Account Fees | $0 |

Minimum Balances | Varies depending on the account |

Checking Accounts | 1 checking account |

Saving Accounts | 1 savings account |

Money Movement | • 125 free transactions per month • Domestic outgoing wires: $40 • International outgoing wires: $75 • Up to $2,500 in free cash deposits monthly |

Cards | • 1 debit per account • Credit cards available |

Financing | • Online loan application • Short-term and long-term loans available • Need to have at least 640 credit score and 25% down |

Customer Service | Available online and at over 2,400 branches |

1.3/5 |

Verdict: U.S. Bank is best for short-term loans

U.S. bank is best for short-term loans up to $250,000. You can easily apply for and manage your loan through online banking, at no cost and get flexible terms up to 84 month.

Wells Fargo

With over 5,000 branch locations, Wells Fargo has the most brick-and-mortar locations of any bank in the U.S. If you prefer conducting your business banking in person and with a bank that has a variety of small business loan options, then they’re a great fit.

Wells Fargo is the largest lender of small business administration or SBA loans. These are long-term small business loans partially guaranteed by the government that often have smaller down payments compared to conventional loans. The money can be used for real estate investments, or in other aspects like buying equipment or acquiring other businesses.

Banking Feature | |

|---|---|

Account Fees | $10, waivable |

Minimum Balances | $500, but a deposit of $1,000 needed to open account |

Checking Accounts | 1 checking account |

Saving Accounts | 1 savings account |

Money Movement | • 100 free monthly transactions • Domestic outgoing wires: $30 • International outgoing wires: $45 • Up to $5,000 in free cash deposits monthly |

Cards | • 1 debit per account • Credit cards available |

Financing | • SBA loans up to $11.5 million for up to 25 years with interest rates as low as 1.75% • Lines of credit and standard real estate financing also available |

Customer Service | Online or at over 8,000 branches |

1.9/5 |

Verdict: Wells Fargo is best for SBA loans

Wells Fargo is best for businesses with a lack of credit history. As a preferred SBAlender, they offer a faster loan process with reduced paperwork for businesses that have been in operation for less than two years.

Bank of America

Bank of America’s Business Advantage Fundamentals Banking package includes a large number of deposits and access to thousands of storefront locations and ATMs nationwide.

Qualifying members with a three-month combined average daily balance of $20,000 also have access to a wide range of Preferred Rewards For Business, including lower interest rates on mortgages and home equity loans.

Banking Feature | |

|---|---|

Account Fees | $16 monthly fee, waivable |

Minimum Balances | None |

Checking Accounts | • 1 free checking account • Second checking account: $16/month |

Saving Accounts | Adding a savings account: $10/month |

Money Movement | • 200 free monthly transactions • Domestic incoming wire: $15 • Domestic outgoing wire: $30 • Up to $7,500 in free cash deposits monthly |

Cards | Credit cards available |

Financing | • Mortgages • Home equity loans |

Customer Service | Branch or online customer service via phone or email |

1.4/5 |

Verdict: Bank of America is best for interest rate discounts on loans

Bank of America is the best fit for mature businesses with a lot of cash. Though $20,000 minimum is a steep price, if your business qualifies, you get access to a wide range of rate reductions and savings — which continue to compound the more you bank with Bank of America.

Capital One

If your small business has a high monthly transaction amount, you’ll need a bank account that doesn’t nickel and dime you for every check or wire you send. Most banks will have a transaction limit, but Capital One’s Unlimited Checking is truly unlimited without any additional transaction fees. This, coupled with their real estate financing options, make them a great choice for real estate investors who need to move money often.

Banking Feature | |

|---|---|

Account Fees | $35, waived if prior 30- or 90-day balance averages $25,000 or more |

Minimum Balances | $250 |

Checking Accounts | 1 checking account |

Saving Accounts | 1 savings account |

Money Movement | • FREE unlimited transactions • Free incoming wires and five free outgoing wires each month • Free cash deposits up to $40,00 |

Cards | • 1 debit card • Several business credit cards available |

Financing | • Real estate term loans up to $5 million with fixed payments and term lengths up to 20 years • Lines of credit • SBA loans |

Customer Service | In-person, Web, iOS, or Android |

1.3/5 |

Verdict: Capital One is best for unlimited transactions

Capital One is best for transaction-heavy real estate businesses that need to move money often.

Consider Relay for your real estate banking needs

Whether you’re a seasoned investor or just starting out on your real estate journey, you’ll need a business bank account for your real estate investment portfolio.

Relay is a real estate investor-friendly bank that helps you spend, save and plan more efficiently with unparalleled clarity into operating expenses, cash flow and accounts payable. Make the switch today.