Centralize your team cards, bill pay workflows, and expense management into a single platform, so you can enforce spend policies, set approval rules, and eliminate surprises, freeing you to focus on growth.

Relay is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank, member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. The Relay Visa Credit® Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc and may be used anywhere Visa credit cards are accepted.

As your business grows, you need to start delegating the day‑to‑day purchases and operations to your team. In a home services business, an HVAC tech needs to buy $100 in filters, but might use their company card to toss a $200 specialty tool into the cart too. The office admin might renew a subscription and upgrade it to a premium plan without your knowledge. Every swipe and bill, necessary or not, adds up fast.

When your team spends without clear guardrails or real‑time oversight, those small, scattered transactions quickly chip away at cash on hand and make it hard to forecast. Without a unified way to monitor and approve spend, you’re often left scrambling at month‑end and wondering where the money went.

Many business owners tell us they hesitate to issue cards because they can’t see what’s being spent until after the cash is gone. Some owners want to pre-approve large purchases, while others want very careful control over their team spending, like "anything over $100 should have my approval before it’s charged."

That’s why we’re excited to introduce card spend approvals, a new feature that gives business owners the ability to require pre-approval for purchases made on an employee’s Relay debit or credit card. This gives you confidence to issue Relay cards to your team, while protecting you from unauthorized spend.

Card spend approvals are just one part of Relay’s unified spend control suite, which includes:

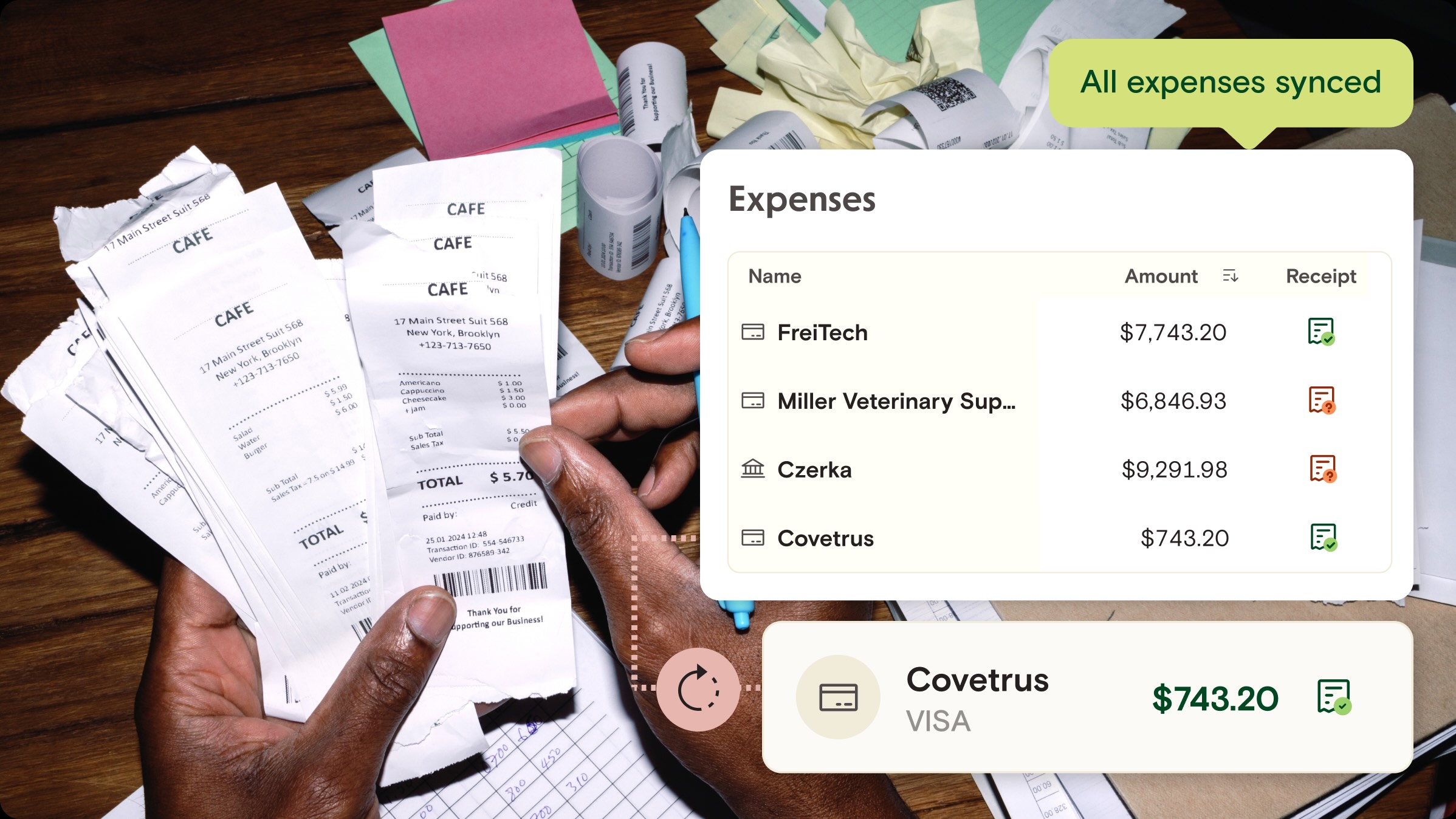

Expense management to capture and reconcile all your outgoing spend and receipts, and sync them to your accounting software

Bill pay approval workflows to ensure the right person or multiple people approve outgoing bill payments

Together, these tools help you enforce consistent policies, reduce manual work, and maintain healthy cash flow, so you’re never blindsided by an unexpected charge again.

Choose the plan that fits and unlock more as you grow

Relay’s plans are designed to meet the needs of businesses at every stage of the profitability journey:

Starter ($0/monthly subscription fee) for core financial workflows.

Perfect for: Solopreneurs and new business owners

Who care about: Building a great foundation for cash flow clarity and breaking even

Includes: Multiple checking and savings accounts, cards, receipt and expense management, invoice creation, payment processing, and accounting integrations

Grow ($30/monthly subscription fee) for advanced financial workflows and customization.

Perfect for: Growing businesses with small teams

Who care about: Achieving consistent profit, without losing control of team spending

Includes: Everything in Starter, plus advanced features like card spend approvals

Scale ($90/monthly subscription fee for a limited time—regularly $120) for more automation and financial insights.

Perfect for: Bigger teams with six figures in annual revenue

Who care about: Hitting peak profit by maximizing margins and improving financial decision-making

Includes: Everything in Grow, plus AI-powered automation, dashboards, and real-time insights

If you’re not ready for advanced approvals today, sign up for Relay Starter at no cost to set up team cards and basic expense policies. As your needs grow, upgrading to Grow or Scale unlocks card spend approvals and additional automation, giving you more control as things get more complex.

Card spend approvals mean no surprise swipes

With Relay, you can create up to 50 virtual or physical debit and credit cards, and issue them to your team. Each card has its own limit, receipt policy, and built-in restrictions around where it can be used (called vendor/category restrictions).

Now, Relay's new card spend approvals feature puts even more guardrails around those everyday purchases that can chip away at your cash flow. It works with all employee cards and lets you decide which transactions need your sign‑off and which can proceed automatically.

Relay is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank, member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted.

How It Works:

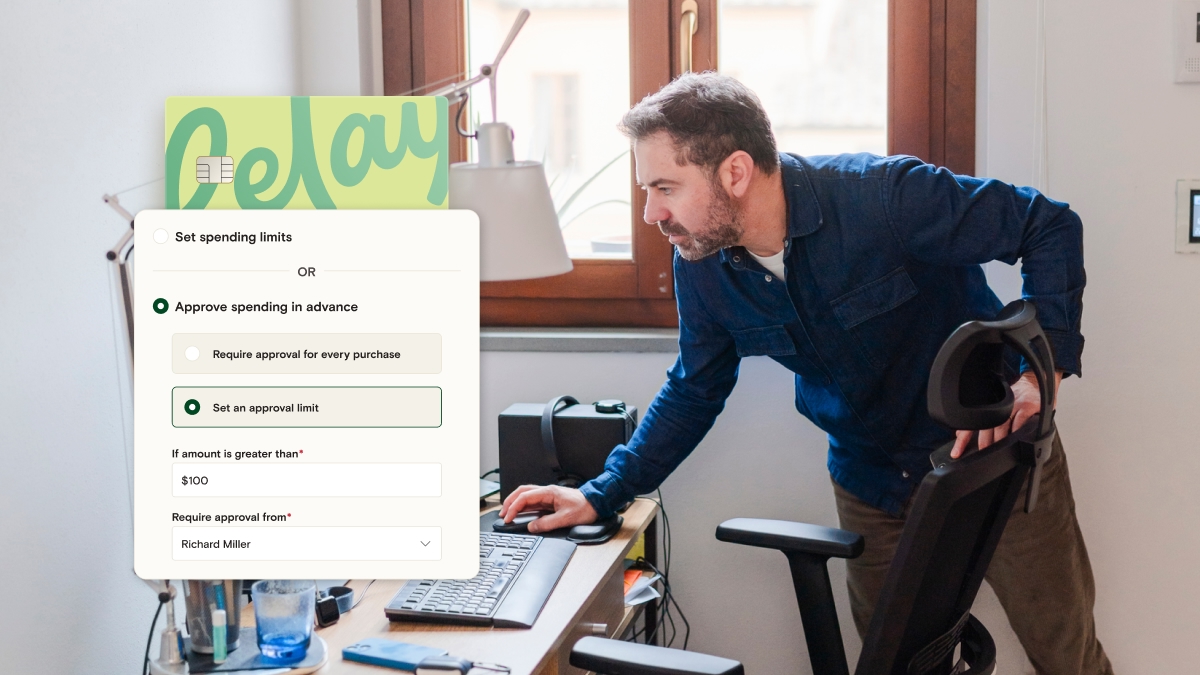

Create an employee card with an approval rule: When you issue a card to an employee (physical or virtual), you can set an approval rule, where every purchase, or only transactions above a set amount, needs approval.

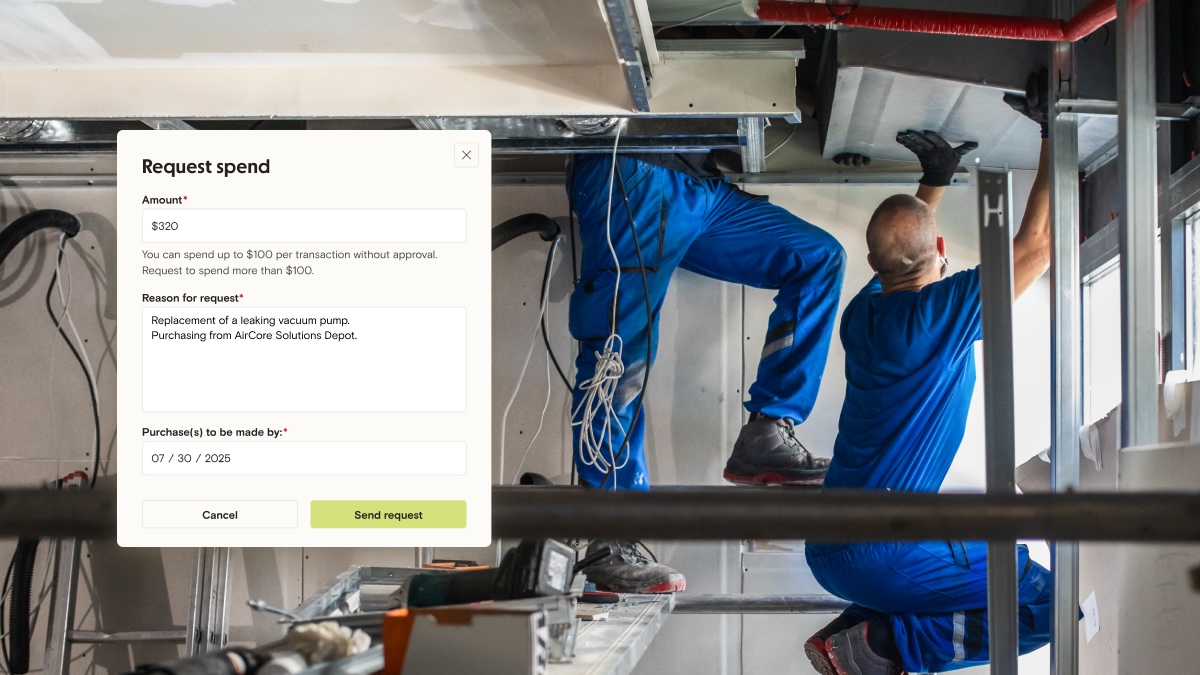

Employees request pre-approval to spend: Before making a purchase that requires approval, a team member taps “Request Spend,” enters the amount, reason and date, and you’re notified right away.

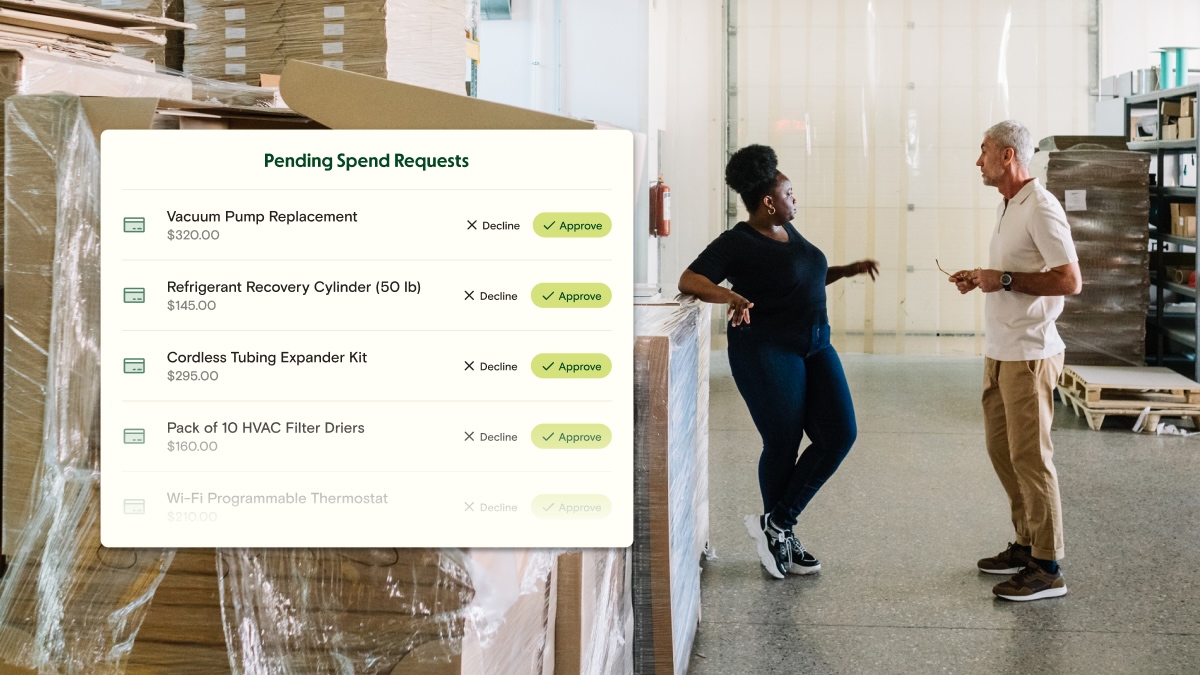

Approve or decline with ease: Admins and managers see all pending requests in a single dashboard, review the context and approve or deny with one click. Employees can then spend up to the approved amount by the approved date.

Keep an audit trail: Every request, approval and transaction is logged. Relay syncs them automatically to QuickBooks or Xero, so you have end‑to‑end visibility and can reconcile without digging through emails or texts.

By building approval rules directly into each card, you let your team spend what they need to keep operations running smoothly, while retaining the oversight that prevents those small purchases from snowballing into cash flow surprises.

Bill approvals: control every outgoing dollar

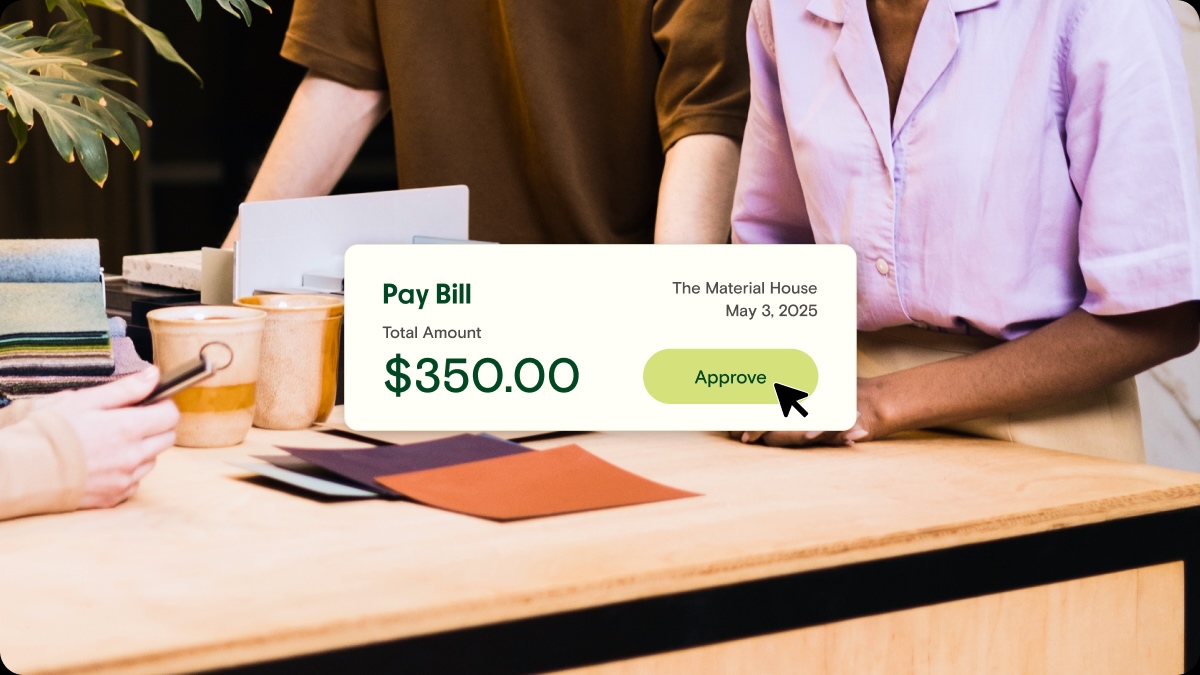

In a home‑services business, bills range from a few hundred dollars for standard filters to several thousand for a full furnace replacement. To keep those payments from sneaking up on you, Relay’s bill approval workflows (available on Grow and Scale plans) let you define dollar thresholds and route bills to the right approver—whether that’s a manager, finance lead or owner.

For higher‑value bills, you can chain together multi‑stage approvals so a $200 supply order clears in one click while a $5,000 equipment purchase gets the scrutiny it deserves.

Relay auto‑extracts vendor details and due dates, batches multiple approved bills to the same supplier into a single payment, and syncs everything to QuickBooks or Xero.

That way, every bill you pay has a clear approval trail, and you always know where the money went.

Expense management: control every transaction

Centralize expense management with Relay by automating receipt capture, matching, and categorization in one platform.

Require receipts for any spend over $75 (or for all transactions), and Relay will instantly nudge employees to snap a photo or forward a digital receipt the moment they swipe their card.

Forward receipts to your Relay inbox, and they’ll be matched to the correct transaction automatically. Import your chart of accounts, set rules like “Fuel → Vehicle Expenses” or “Tools → Equipment,” and even split mixed charges into precise line items (available on Grow and Scale plans).

At month-end, hit Sync to push your fully reconciled, categorized expenses to QuickBooks or Xero, no manual exports or uploads required.

No more chasing paperwork or missing receipts, just clean, controlled spend.

The controls you need to keep your cash flow healthy

Untracked team spending doesn’t just nibble at your margins, it erodes cash flow, delays month‑end, and steals your focus from serving customers. Relay’s unified spend control suite is designed to give you the best of both worlds: the confidence to delegate day‑to‑day purchases and the oversight to prevent small, scattered transactions from snowballing into financial headaches.

Ready to make surprise swipes and last‑minute reconciliations a thing of the past? Sign up for Relay Starter to experience unified spend control, and upgrade to Grow or Scale when you’re ready for more guardrails. Your team gets the flexibility to do their jobs your cash flow gets the protection it deserves.