With this partnership, we’re bringing our two matching tools closer together—creating greater cash flow control and profitability for business owners. And to support your business more deeply, we’re also launching auto-transfer rules, a new Relay feature that automates Profit First allocations.

The stark truth is that many entrepreneurs live check-to-check. Almost all, at some point, experience cash flow challenges. Relay is on a mission to give every business owner total clarity about what they’re earning, spending and saving. And there’s no better way of doing that than implementing the Profit First method with Relay—as 3,000+ businesses have already done.

That’s why Relay is now the official banking platform for Profit First.

Watch: Partnership announcement

https://www.youtube.com/embed/x23SZg0VmH0

The two matching tools for business owners

We’ve seen first-hand how Profit First, paired with Relay, improves financial visibility for businesses.

For those new to it, Profit First is a cash management system created by New York Times bestselling author and small business expert Mike Michalowicz. It’s an intuitive way to manage cash in your business and ensure permanent profitability. And because Relay’s platform fits the Profit First method so well—with multiple no-fee checking accounts, percentage-based transfers, and newly-launched auto-transfer rules (more on that below!)—the two create unparalleled cash flow clarity.

“I call it instant intelligence. You log into Relay, you know your exact cash position at the moment, and you can move forward with the next decision. That’s what small business owners need.” - Mike Michalowicz, Creator and Author of Profit First

There’s an even deeper alignment between Profit First and Relay: a shared belief that business advisors—accountants, bookkeepers and coaches—play a critical role in the lives of business owners.

At Relay, this belief is reflected in our banking platform, which is built to meet the needs of advisors as much as business owners. And it’s also reflected through Profit First Professionals (PFP)—a member organization of accountants, bookkeepers and Profit First business coaches, Co-Founded by Mike Michalowicz and Ron Saharyan in 2014.

Because of these shared communities and commitment to business owners, we’re so excited to come together and build tools that keep you on the money.

True support for Profit First banking

https://www.youtube.com/embed/AxVGAo71TrM

“Who should I bank with?” is the most common question posed to Mike and Ron. Finding a banking solution that truly supports the Profit First method can be challenging; Relay does it out of the box.

Multiple checking accounts without minimums

Relay lets business owners open up to 20 real checking accounts (not just envelopes) — for free and without minimum balance requirements. You can also open accounts 100% online, without the hassle of visiting a branch or negotiating with a bank teller.

<!-- EMBEDDED_ENTRY_INLINE:5aN2V4kHU4Pz2HXZfN5Jz8:inlineCta -->

Percentage-based transfers

In addition to multiple checking accounts, Relay has also made it easy to allocate revenue between accounts with percentage-based transfers. It’s one of the reasons why so many Profit First users already bank with Relay: you can transfer money from one to multiple checking accounts in one go. Just select the accounts and percentages, and Relay takes care of the math.

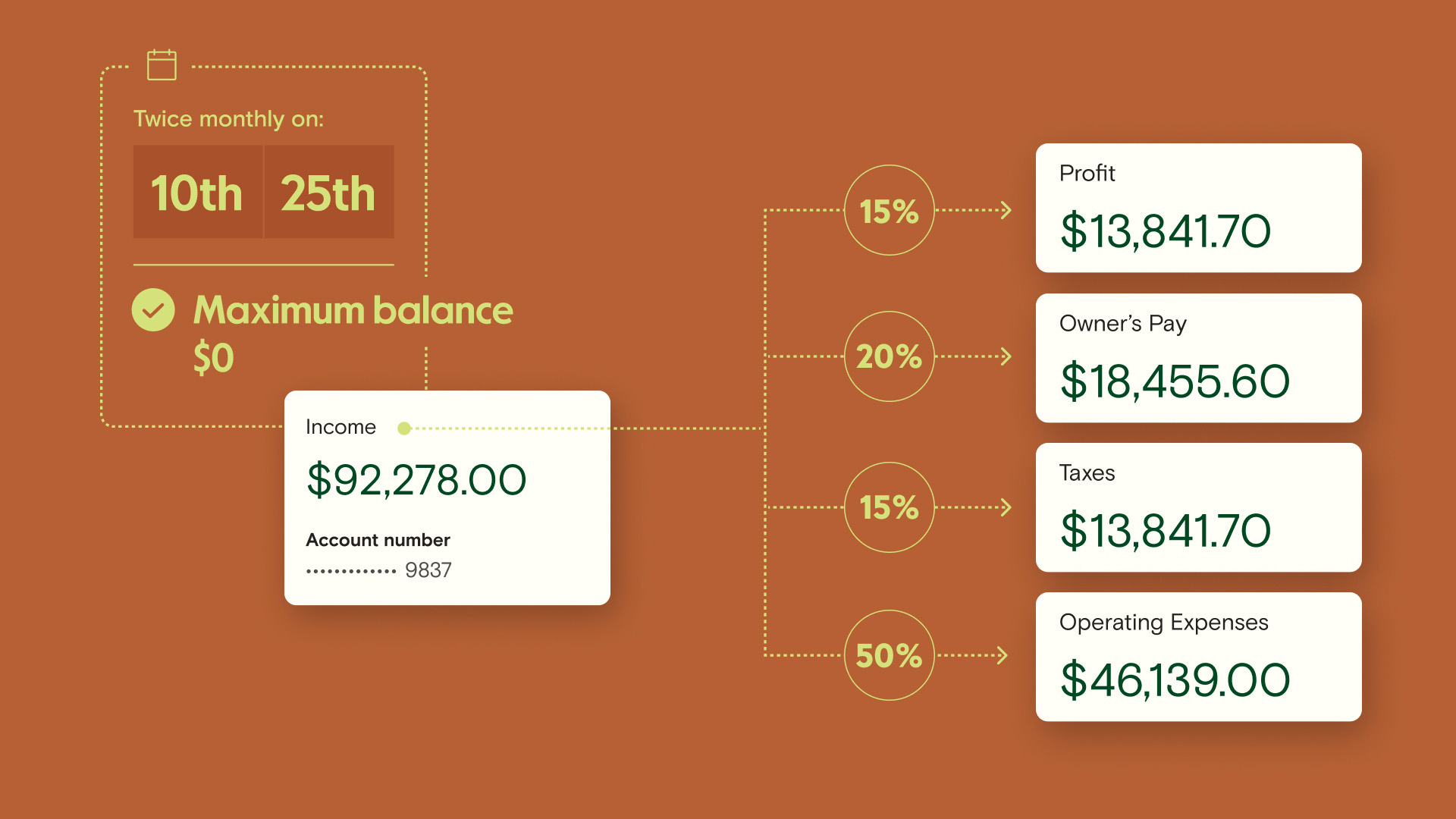

Automate allocations with smart transfer rules

We’re also incredibly excited to launch auto-transfer rules as part of this partnership—a tool that automates Profit First allocations.

Relay customers can now automatically allocate their income to different checking accounts—Profit, Taxes, Owner’s Comp and Operating Expenses—without lifting a finger.

“You can avoid a spreadsheet. You can avoid your accounting system. You can't avoid Relay.” - Mike Michalowicz, Creator and Author of Profit First

How auto-transfer rules work:

Schedule daily, weekly, twice-monthly or monthly transfers

Choose your source account (e.g., Income) and set a maximum balance

Customize the allocation percentages and destination accounts

Watch transfers happen without lifting a finger

Relay 2.0 customers can set up auto-transfer rules by logging into their account. And if you’re new to Relay, and looking for Profit First banking, we invite you to learn more about Relay’s platform here.

<!-- EMBEDDED_ENTRY_INLINE:2ub48BYrxuYqnf0PJ8kMNa:inlineCta -->

Collaboration between business owners and advisors

For those who coach clients on Profit First in Relay, as well as the businesses that work with a coach, we make collaboration secure and easy. Relay gives you a simple way to manage all of your clients, making you that much more effective.

“The way that Relay has architected their platform gives Profit First Professionals the ultimate view into all of their clients’ cash positions. Relay helps PFPs succeed and helps their clients succeed as well.” - Ron Saharyan, Co-Founder, Profit First Professionals

A partnership to better serve small businesses

In addition to Profit First-friendly features in Relay, you can expect deeper Profit First expertise across Relay’s team, practical resources built in collaboration with the Profit First Professionals network, and recommendations to Certified Profit First Professionals when you need them.

Relay is a Profit First Certified firm

Profit First Certified Professionals are business coaches that have taken the certification offered by Profit First University, have a deep understanding of the Profit First method, and can consult businesses on profitability. As part of our commitment to Profit First, Relay has become a Profit First Certified firm, with members of our team completing the PFP training. Meet Relay’s newly-certified PFPs: Deanna Zubrickas and Olivia Cummings. By having in-house expertise, we'll be able to serve both Profit First Professionals and small business owners more deeply.

Find a Certified Profit First Professional

Profit First Professionals are certified coaches that help you run more sustainable, healthy, and profitable businesses. Working with a PFP can help you stop living check-to-check, create a cash cushion, increase your profitability, and reach your financial goals. If you’re looking to take the next step in implementing Profit First, you can find a Certified PFP here.

<!-- EMBEDDED_ENTRY_INLINE:5u7WqtT2JStC96vVI8AzCB:inlineCta -->

Tailored onboarding for current and aspiring PFPs

Profit First Professionals new to Relay can get a personalized demo, including how to get the most out of Relay’s newly-launched auto-transfer rules. Don't hesitate to contact our team and book a walkthrough with our Certified PFP, Deanna Zubrickas.

During the walkthrough, you will identify pilot program participants, set up and test your Relay account, and learn about our Partner Program. We also provide a dedicated onboarding experience and an account manager for PFPs. This includes helping your clients onboard to Relay and training them on how to get the most out of Relay’s platform.

Webinar: Becoming permanently profitable with Relay and Profit First

To kick off our partnership, we will be co-hosting a live virtual event with Mike Michalowicz on 🗓 April 4th, 12:30 p.m. PT / 3:30 p.m. ET. Join to learn more about why Relay is becoming the official banking platform for Profit First, meet the Profit First Professionals community, learn how you can get the most out of this new collaboration, and see the new auto-transfer rules in action.

💵 How to get cash flow clarity with Relay and Profit First

🚢 How to implement Profit First with Relay in 3 simple steps

🧠 Demo of how to get the most out of Relay’s auto-transfer rule

🌏 Ways to get practical resources for managing cash flow in your business

👕 T-Shirt and 📚 book giveaway for those that register

>>> Save your spot

We’re so excited to join forces with Profit First to keep you on the money!