You’re looking for the best features: low to no monthly fees, easily available online banking systems and applications, and maybe even an ACH transfer service. Seems easy enough, right?

But with over 4,000 FDIC-insured banks in the U.S., there are so many options to choose from. Where do you even start?!

Don’t worry, Relay has you covered! 😮💨 In this blog, we'll help you discover the absolute best banks (and business bank accounts) for self-employed professionals.

Do I need a business bank account if I’m self-employed? 🤔

The short answer? Yes. It’s a good idea!

If you’re an LLC, it’s highly recommended to have a dedicated business bank account to protect you from liability and keep your personal and business funds separate. Even if you’re a sole proprietor, it’s still a very good idea to open a business bank account for tax purposes.

💵 Benefits of having a business bank account

Whether you're self-employed as a freelancer or a small business owner, here are a few more reasons to consider opening a dedicated business checking account.

🏦 Simplify taxes

When you’re self-employed, you’re responsible for paying your own taxes. If you run your business expenses and income through your personal account, you’ll find that calculating business income and expenses quarterly is a headache. By separating the two accounts, you'll majorly simplify tax season. 😇

📖 Better bookkeeping

Keeping your books straight is the best way to prepare for an unexpected audit. 📚 Plus, this will help you get a clear understanding of your income and expenses—equipping you to make smarter financial decisions for your business.

👩💼 Professional etiquette and credibility

By having a business bank account, you’ll receive checks and cards 💳 in your business’ name, and transactions between you and customers (or you and other businesses) will be through a properly named account for your business. This will boost your business’s credibility and help you appear more professional to clients.

Overall, it’s definitely worth it to have a business bank account that’s separate from your personal checking account. But how do you choose which banking platform to open an account with? 😬

How to choose a business bank account when you’re self-employed

When choosing a business bank account, you’ll want a healthy balance of features (such as low minimum balance requirements) and low fees (like transaction fees). You'll also want to choose a banking option that helps simplify your finances—instead of over-complicating them.

Here are a few more things to consider when opening a business bank account, as a self-employed professional.

Traditional banks vs. online banking platforms

Let’s talk about traditional banking versus online banking platforms.

It’s true that for most of banking history, banks have had brick-and-mortar locations. They've required in-person visits to apply for new accounts, to make changes to accounts, or to acquire new cards, all with increasingly complex applications. This often means that it can take several days to weeks to actually open an account. 🥱

Online banking platforms like Relay (that’s us! 👋) aren’t burdened by old infrastructure and complex rigamarole like traditional banks. They’re able to modern, convenient features designed uniquely for small business owners—like virtual debit cards and fast B2B ACH payments. Plus, online banking platforms typically allow you to open your account entirely online.

If you're self-employed, and you don't want to go through the time-consuming process of opening a bank account with a traditional bank, an online banking platform might be the perfect solution. 🙌

Other factors to consider

It’s easy to get overwhelmed by this decision, but by prioritizing the following features and perks, you’ll end up with a business bank account that works best for you!

Online banking features 💻

If you expect to be able to get banking done wherever and whenever you are, you should ensure that your banking institution has online banking features like a mobile app and website. Some traditional banks do have mobile apps and other features, but not all.

Unless you’re willing to wait until business hours, go into a physical branch, and/or have to phone someone every time you want to make account changes or view your accounts, online banking features are crucial for the self-employed.

Minimum balance requirements 💰

When you're self-employed, the amount of cash you have on hand might fluctuate—especially if you’re just getting started. This can make it tough to meet minimum balance requirements and avoid those pesky monthly maintenance fees.

The good news is that most online banking platforms have low minimum balance requirements. Relay, for example, allows small business owners to open up to 20 free business checking accounts per business entity with no minimum balance and no monthly maintenance fees! 🥳

Account fees 💸

Hidden costs and fees can add up fast when it comes to business banking. 😰 Remember to compare things like maintenance fees, service fees, overdraft fees, or withdrawal fees when choosing a business bank account.

Payments 💲

The ability to make and accept payments is one of the most important features of a business bank account. You’ll want to know if your bank allows to you make and receive wire transfers 🔁 and ACH payments for free or with an associated cost.

It’s also important to consider whether you’ll be making many cash deposits. 💵 Digital and online banking platforms may not accept cash deposits as easily as traditional banks might. However, the best online banking platforms (including Relay) will allow you to deposit cash at easily accessible ATMs.

Security 🔐

It’s your money in the bank, and that needs to be protected! Remember to check if the banks you're considering offer two-factor authentication (2FA). You'll also want to consider if you can freeze your debit cards or change the PIN numbers online, if needed.

FDIC insurance 🪙

It’s a common misconception that all banks have to have FDIC insurance legally. While many banks have it, not all do. In the event of a bank failure, FDIC insurance will protect your money and reimburse you up to $250,000. Be sure to compare FDIC insurance when choosing a bank for your small business.

The 10 best business bank accounts for self-employed professionals & freelancers

Now that you know what to look for, let’s get down to it: here’s a list of the 10 best bank accounts for self-employed professionals and freelancers! 📝

💵 Relay

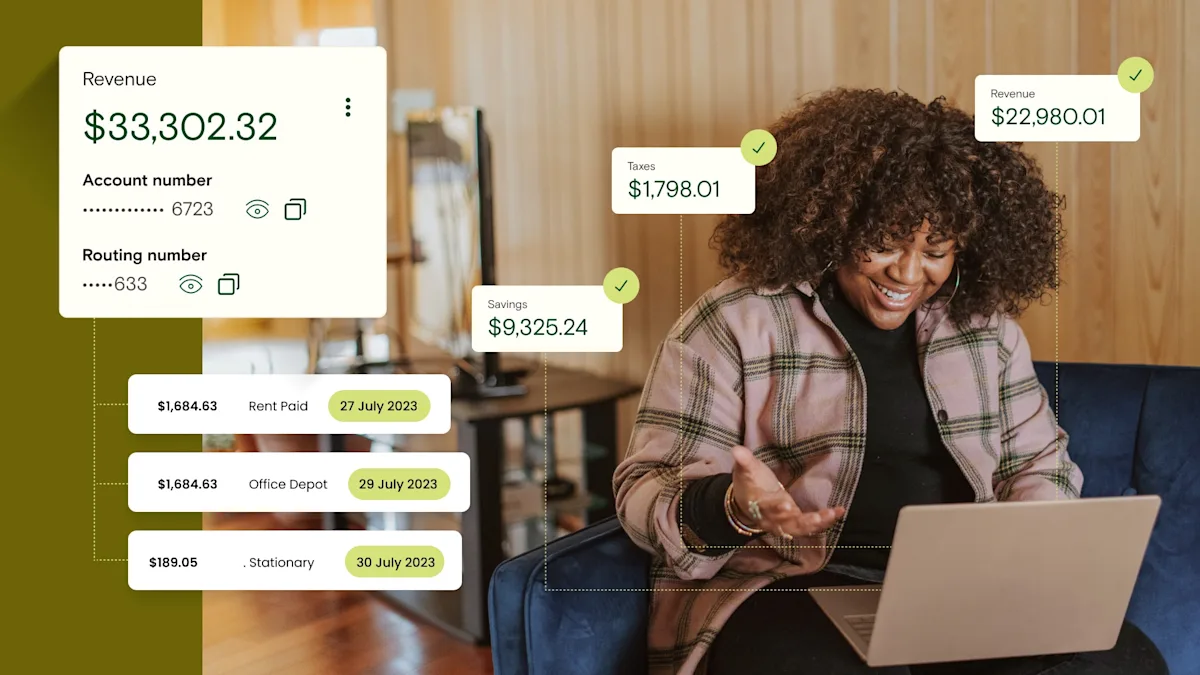

Relay is an online banking and money management platform built specifically for small business owners. At Relay, we’ve designed features that solve the pain points of traditional banking, like high account fees and poor visibility into cash flow. 💸

With Relay, you can open up to 20 individual, no-fee business checking accounts and two savings accounts. Relay also helps you get crystal clear on monthly spending and speed up bookkeeping with enriched, automatically categorized transaction data.

Audiences/Businesses Served: Small businesses with up to 100 employees

# Free Checking Accounts: 20 (all with unique account and routing numbers)

Pros:

✅ No monthly account fees, overdraft fees, or fees for monthly transactions

✅ No minimum account balances

✅ Mobile banking

✅ Free ACH payments (and same-day ACH with Relay Pro)

✅ Up to 50 separate debit cards and virtual card availability

✅ Earn up to 2.86% APY1 on savings

✅ FDIC-insured (with Thread Bank)

Cons:

❌ No physical branches

The bottom line: Relay is a great online banking platform with a ton of features (and even more unlocked with their Relay Pro plan). It’s best for small business owners and those looking for an accessible, convenient, and free business banking platform.

💵 Bluevine

Bluevine is a financial technology company that offers checking, lending, and payment products. They have both a free version and a Premier version for business owners. We’ll focus on Bluevine's business checking account.

Audiences/Businesses Served: Businesses wanting to generate interest on larger sums of cash or have a line of credit

# Free Checking Accounts: 1 with 5 virtual reserve accounts (also known as sub-accounts)

Pros:

✅ High-yield checking accounts available

✅ Lending options

✅ FDIC-insured (with Coastal Community Bank)

Cons:

❌ No savings accounts

❌ Fee for depositing cash

The bottom line: Bluevine is great for business owners who have a large sum of cash that can generate interest. It may not be the best option for those who deposit cash regularly due to its associated fees.

💵 Novo

Novo is an online banking solution for small businesses and freelancers. It has options for integrations and sending invoices, in addition to offering powerful security, instant card controls, and perks for its partners.

Audiences/Businesses Served: Solopreneurs, entrepreneurs, and freelancers

# Free Checking Accounts: 1, with 10 sub-accounts

Pros:

✅ Plenty of integrations, including with Quickbooks and Stripe

✅ ATM fee reimbursements at the end of each month

✅ No monthly hidden fees or minimum balances

✅ FDIC-insured (with Middlesex Federal Savings)

Cons:

❌ No savings accounts or lending ability

❌ Overdraft fees and same-day ACH fees

The bottom line: Novo is a good option for those who use Stripe, Square, PayPal, or similar platforms to send money regularly. It also has good customer support options. However, for those looking for wire transfers, Novo only allows those through third-party integrations.

💵 Lili

Lili is a business finance platform with both banking services and invoicing, tax preparation, and accounting software. They are tailored for small businesses, as they are only available to sole proprietorships or single-member LLCs filing as sole proprietorships.

Audiences/Businesses Served: Small businesses (sole proprietorships) looking for an online banking platform

# Free Checking Accounts: 1

Pros:

✅ Savings accounts for Pro, Premium, and Smart users (4.15% APY)

✅ Free ATM withdrawals for thousands of ATMs across the U.S.

✅ Fee-free transactions and unlimited transactions

✅ FDIC-insured (with Choice Financial Group)

Cons:

❌ No wire transfers

❌ Some of the best features are only available to Pro and above users

❌ Only one free checking account

The bottom line: Lili is great for small business banking, but not for larger businesses. Expect to pay at least some premiums for better features.

💵 NorthOne

NorthOne is an online business banking platform that offers sub-accounts (instead of individual checking accounts). It offers low account fees, unlimited sub-accounts (also known as envelopes), and the convenience of a mobile app.

Audiences/Businesses Served: Small businesses, freelancers, and startups

# Free Checking Accounts: 1, with unlimited sub-accounts

Pros:

✅ Ability to deposit cash at nearly 100,000 GreenDot ATM locations

✅ Mobile banking solutions

✅ Free ACH transactions

✅ FDIC-insured (with The Bancorp Bank)

Cons:

❌ Monthly account fees

❌ No support for wires

❌ No savings accounts

The bottom line: NorthOne is a good option for those needing to deposit cash or make ACH transactions, but if you’re looking for a no-fee option, you may want to try a different banking platform.

💵 Capital One

Capital One offers both online banking and some physical branches for a variety of customers, including consumers, small businesses, and large firms. They offer two plans for small businesses: Basic Checking and Enhanced Checking.

Audiences/Businesses Served: Both small and large businesses wanting online options for banking

# Free Checking Accounts: Up to 2 Basic Checking accounts with either plan

Pros:

✅ Mobile app and 24/7 online account access

✅ No fees for digital transactions, including ACH payments and online bill pay

✅ Mobile check deposit available

✅ FDIC-insured

Cons:

❌ Monthly fees that are only waived with account balances of $2000 (for Basic Checking) or $25,000 (for Enhanced Checking)

❌ Fees for outgoing domestic wires after a certain number and fees for incoming domestic wires for Basic Checking plan members

The bottom line: Capital One offers a good amount of online banking features and is more flexible than some options, but is limited in the number of checking accounts you can have. Additionally, it has relatively high fees.

💵 Chase

Chase is a traditional bank that offers many services, including personal and business checking accounts, business loans, and business credit. They have three plans for businesses, but their Chase Business Complete Banking plan is designed for small businesses.

Audiences/Businesses Served: Businesses wanting a full range of services from a single provider

# Free Checking Accounts: 0, but sometimes fees can be waived for qualifying accounts

Pros:

✅ Many physical branch locations

✅ Mobile banking and the ability to open accounts online

✅ Unlimited debit card and Chase ATM transactions

✅ ACH available

✅ FDIC-insured

Cons:

❌ Monthly fees for both plans unless certain circumstances are met

❌ ACH payments come with fees

❌ ATM fees at non-Chase ATMs are not reimbursed

The bottom line: If you’re looking for an all-in-one suite of business solutions and lenders, Chase may be a good option. However, their flexibility is limited in terms of the number of checking accounts you can have.

💵 Bank of America

Bank of America is an investment bank for small businesses, middle-market businesses, and large corporations alike. They offer two plans for business banking: Business Advantage Fundamentals Banking and Business Advantage Relationship Banking.

Audiences/Businesses Served: Small, medium, and large businesses wanting branch banking options

# Free Checking Accounts: 0 for Fundamentals Banking plan, 1 for Relationship Banking plan

Pros:

✅ Many physical branch locations

✅ Mobile banking with ACH options (see related con below)

✅ Business credit cards with rewards available

✅ FDIC-insured

Cons:

❌ Monthly fees for both plans unless certain requirements are met

❌ Most ACH payments aren’t same-day and fees may apply

The bottom line: Bank of America is a good option for those looking for the ability to visit physical branches and have business credit, but the monthly fees and service fees may turn you away.

💵 Wells Fargo

Wells Fargo is a community-based financial services company with a significant global presence. They offer three plans for small businesses: Initiate Business Checking, Navigate Business Checking, and Optimize Business Checking.

Audiences/Businesses Served: Small businesses looking to grow and save

# Free Checking Accounts: Up to 5 linked accounts, but only with the Optimize Business Checking Account

Pros:

✅ Ability to apply for a new account online (or in person)

✅ Mobile check deposit available with a mobile app

✅ Cash-back reward options with certain business credit cards

✅ FDIC-insured

Cons:

❌ Monthly maintenance fees starting at $10 (unless you maintain a minimum daily balance starting at $500)

❌ Cash deposit processing fees after a certain amount of cash deposited (depends on the plan)

❌ Typical minimum deposit of $25 for business accounts

Overall: Wells Fargo is a good bank for those looking for customized plans and rewards, but not for those looking for low-fee or fee-free banks.

💵 Live Oak Bank

Live Oak Bank is a digital, cloud-based bank dedicated to helping its customers build, buy, or expand their businesses. With options for borrowing and saving and great customer service, Live Oak Bank is a good option for self-employed professionals.

Audiences/Businesses Served: Small businesses looking for multiple services from one bank

# Free Checking Accounts: 1

Pros:

✅ No minimums or maintenance fees

✅ Savings accounts with competitive rates

✅ FDIC-insured

Cons:

❌ Overdraft fees

❌ No ATM access

The bottom line: For those looking for stellar customer service, Live Oak Bank would be a good choice, but they lack some of the features that other banks and platforms have.

The absolute best bank for self-employed professionals 🏆

We toured a wide range of bank accounts; from more traditional banks with physical branches (such as Chase, Bank of America, and Wells Fargo) to online, digital banking platforms (like Relay, Novo, and Bluevine).

Some banks had features like same-day ACH, business debit cards, and mobile check deposit, while some didn’t—and some banks had fees and deposit requirements, while others were fee-free.

Overall, is there a winner for the best bank account for self-employed professionals?

Relay takes the cake! 🎉

With no monthly maintenance fees, no minimum opening deposit requirements, and no overdraft fees, Relay isn’t keeping anything hidden fee-wise. That’s a big win, whether you’re self-employed full-time or launching a side hustle. 💸

Relay also offers…

✅ 20 individual checking accounts: Organize your income and expenses across multiple accounts, and get a crystal clear view of your cash inflows and outflows.

✅ Automated savings: Relay helps you add more breathing room to your budget with automatic savings. Plus, you’ll earn up to 2.86% APY1 on every dollar.

✅ Entirely online banking: Open checking and savings accounts, issue debit cards, and send and receive payments completely online—no in-person branch visits required.

✅ Your money, protected: Feel safe knowing your money is protected by FDIC insurance. Plus, all debit cards are covered by the Visa® Zero Liability Protection Policy.

✅ 50 virtual or physical debit cards: Create new debit cards for specific projects and expenses, and get instant access to virtual debit cards for online and mobile payments.

✅ Streamlined bookkeeping: Relay allows you to sync detailed banking data directly into QuickBooks Online or Xero, making bookkeeping a breeze.

We’re proud of our many features and integrations, and we know you’ll find them just as amazing as we do! Sign up for a free account with Relay today. 💚

📝 FAQs

More questions? We’re here to help!

🤔 Do I need to have an LLC to open a business bank account?

Nope! While LLCs have their advantages and disadvantages, they’re not required to open a business bank account. Many small business owners and freelancers open accounts as sole proprietors. 👍

🤔 Why is having multiple checking accounts a good thing?

Businesses come in all shapes and sizes, and many have multiple cash flows coming in and out daily. With multiple checking accounts, you can have a better idea of what your day-to-day business operations look like and keep certain funds allocated for certain purposes (like expenses, payroll, and tax payments). 👍

🤔 What’s the difference between a sole proprietor and an independent contractor?

A sole proprietor is an independent person who owns an unincorporated business by themselves. This person has not registered with a state as a business entity (like an LLC or corporation).

An independent contractor is someone who is working for someone else, just not as an employee. They do work for this person with a set fee. Usually, independent contractors are creative or technical professionals.

The key difference between the two is the contract work. While sole proprietors may do contract work, they might also have other income sources, such as selling their own products to customers. Independent contractors’ main income comes from contract work with companies. 👍