Since founding Relay in 2018, our mission has been to enable anyone to build a profitable small business. That mission holds true today, and it informs everything we do.

The bad reviews of Relay that I've seen often talk about account freezes, requests for additional documents, or challenges with our customer support. User experiences like this are antithetical to our mission, and I can understand how these reviews could make you uncertain about choosing Relay as your banking platform.

I’d like to address these reviews head-on, and share some first-ever key datapoints to be completely transparent about these online critiques and why they come up.

In almost all cases, these reviews come from experiences relating to our account protection and fraud prevention measures. Some things I’d like to point out:

Most negative reviews are sparked by our fraud prevention measures, which exist to protect our users, and are required of all financial institutions by U.S. law.

When we detect fraud signals, we immediately reach out to the affected business owner to get the details we need to clear the case. We also have a direct phone line for impacted users to contact us directly and speak to a real person (1-888-205-9304).

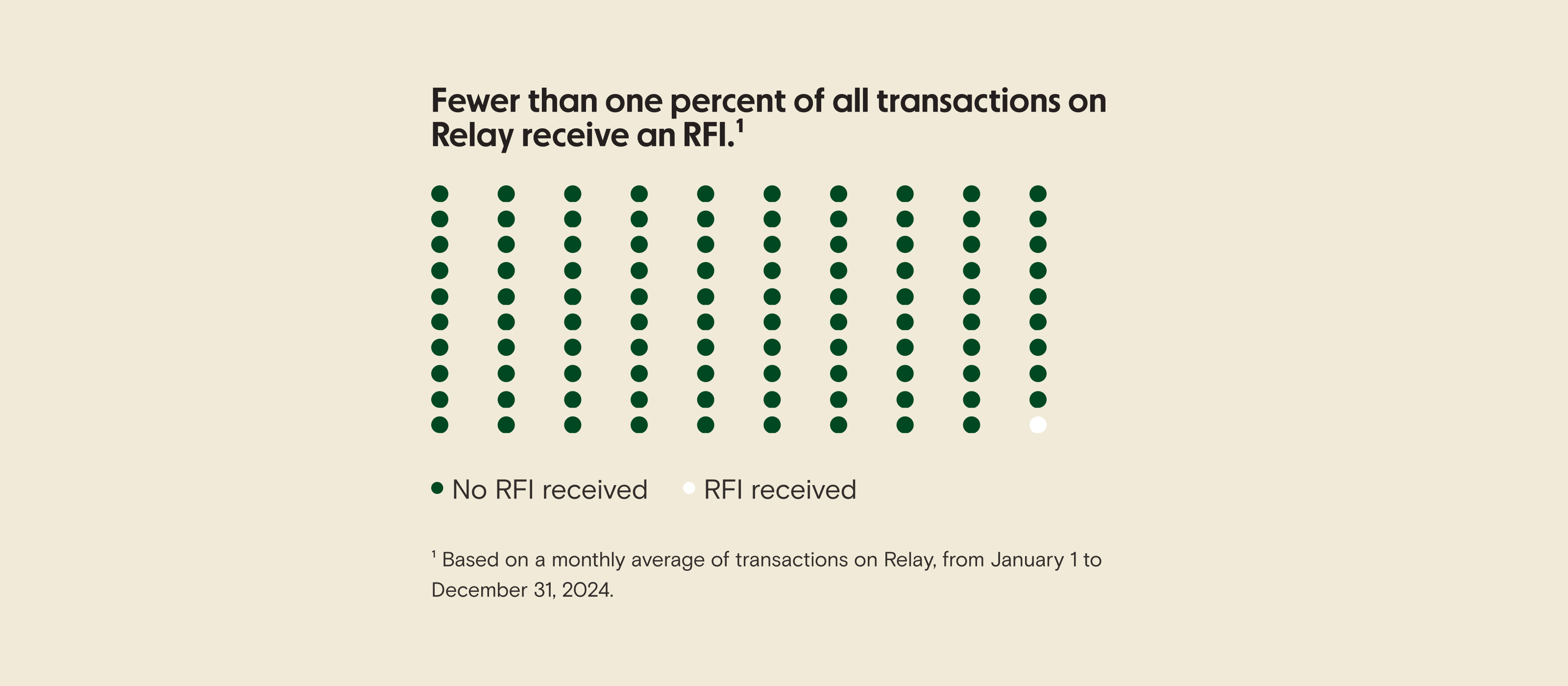

Overall, users navigating these moments represent a very small fraction of our customers; fewer than one percent of all transactions on Relay ever receive a request for information as part of our fraud prevention measures.

We’re giving you the full, clear and data-backed picture of our account protection and fraud prevention because you deserve to understand the actions of your banking provider and feel confident in your business banking.

Behind these reviews, there’s a deeper story to tell. It’s one that—up until now—Relay hasn’t done a great job of explaining. That’s on us. So, I understand why some folks are frustrated and skeptical. When it comes to your business, you’re smart to be cautious in the face of uncertainty. I would be too. Today, I’m going to clear this up.

It’s one thing for me to say, “Regulatory compliance is important to Relay!” And while that’s true—and it’s something we’ve always been vocal about—it means way more if I actually show you the data behind our account protection and fraud prevention steps.

Diving into the bad reviews

Overall, Relay’s online reviews are some of the best in business banking. This is something we’ve worked hard to achieve.

Even still, like any platform, we also receive negative reviews by a small number of frustrated users. Several of these reviews even accuse Relay of “scamming” or “screwing over” small businesses, withholding customer funds for no reason, and even ghosting users. It sucks to read reviews like this because they’re opposite of what Relay stands for: we enable small businesses to grow. While these review claims are untrue, I understand where their frustration comes from.

These are the most common situations that lead to the bad reviews:

1. Requests for more information or documents to process a transaction or open an account

This review could look like: “I wired money into my Relay account and then wired a portion to my business partner. Relay flagged BOTH wires!”

2. Account freezes or closures resulting from a review by our Compliance Team

This review could look like: “Relay froze my account until I sent them information to prove my business was real!”

3. Customer support to help customers navigate these moments

This review could look like: “Relay's customer service is unhelpful and slow to respond!”

In the spirit of transparency, I’ll go through each of these to clarify our approach, why we take it, and how it helps our users.

Why does Relay ask for additional verification documents?

We take steps to verify our users (e.g. requesting additional documents or details) to comply with the federal Bank Secrecy Act (BSA).

This is a law requiring financial institutions (including Relay) to uphold strict reporting so that the federal government can detect and prevent money laundering. It requires financial institutions to verify that their customers are who they say they are; this is called the Customer Identification Program.

For a brick and mortar bank branch, a customer walks into the bank, hands over their photo ID, and the teller can verify them by looking at them. At Relay, we do this digitally. When new customers sign up, we request information during the application process to verify their identity before their account is approved. This includes:

Personal information (e.g. name, date of birth and contact details)

Business information (e.g. business address, size and ownership details)

ID verification data (e.g. government-issued ID, Social Security Number and Employer Identification Number)

This could sound like several steps. To put it into perspective, 92% of all complete account applications submitted to Relay are approved.

We only approve applications that include the necessary information requested so that we can verify them and confirm they are non-fraudulent. The takeaway here is that legitimate businesses considering Relay have nothing to worry about.

Will Relay freeze my account?

Another topic I’ve seen in online reviews is Relay freezing or closing accounts.

To be clear, Relay will not close an account without first warning the account holder or requesting more information. The idea that we shut off access without warning is not accurate.

Here are the steps that come before an account freeze, which is our last resort:

Monitoring for fraud signals: Relay’s always-on fraud detection monitors for signals of illegitimate activity on our platform. When we pick up on fraud signals, we act immediately.

Issuing an RFI: Next we put out a Request for Information (RFI). This is an industry-wide protocol whereby a financial institution asks for more transaction details to verify its legitimacy. RFIs protect consumers from fraud by giving them the chance to validate legitimate transactions, or dispute fraudulent ones.

RFIs at Relay: RFIs at Relay are issued via email. We’ll always include a clear ask and explanation. The response deadline will depend on the transaction, but there’s a minimum one day’s notice (though often longer). We’ll also follow-up via phone to make our best effort to get in touch.

Freezing and closing accounts: When we don’t hear back in time—or if our signals indicate potential fraud—only then do we freeze the account. In cases where we confirm fraud, we close the account and post a check for any outstanding balance to the business address on file. Under no circumstances will Relay keep the outstanding balance of a closed account.

RFIs exist to protect you, your money and your Relay account. The reality is that fewer than one percent of all transactions on Relay ever receive an RFI.

Can I reach a real person for help?

Definitely. This year, Relay launched the Account Protection Team (APT), an expert team of on-call specialists dedicated to guiding customers through account security and fraud prevention. They do this by reviewing, responding to, and resolving customer inquiries about Relay’s security and regulatory compliance actions, so customers are supported and informed at every step. And it’s working.

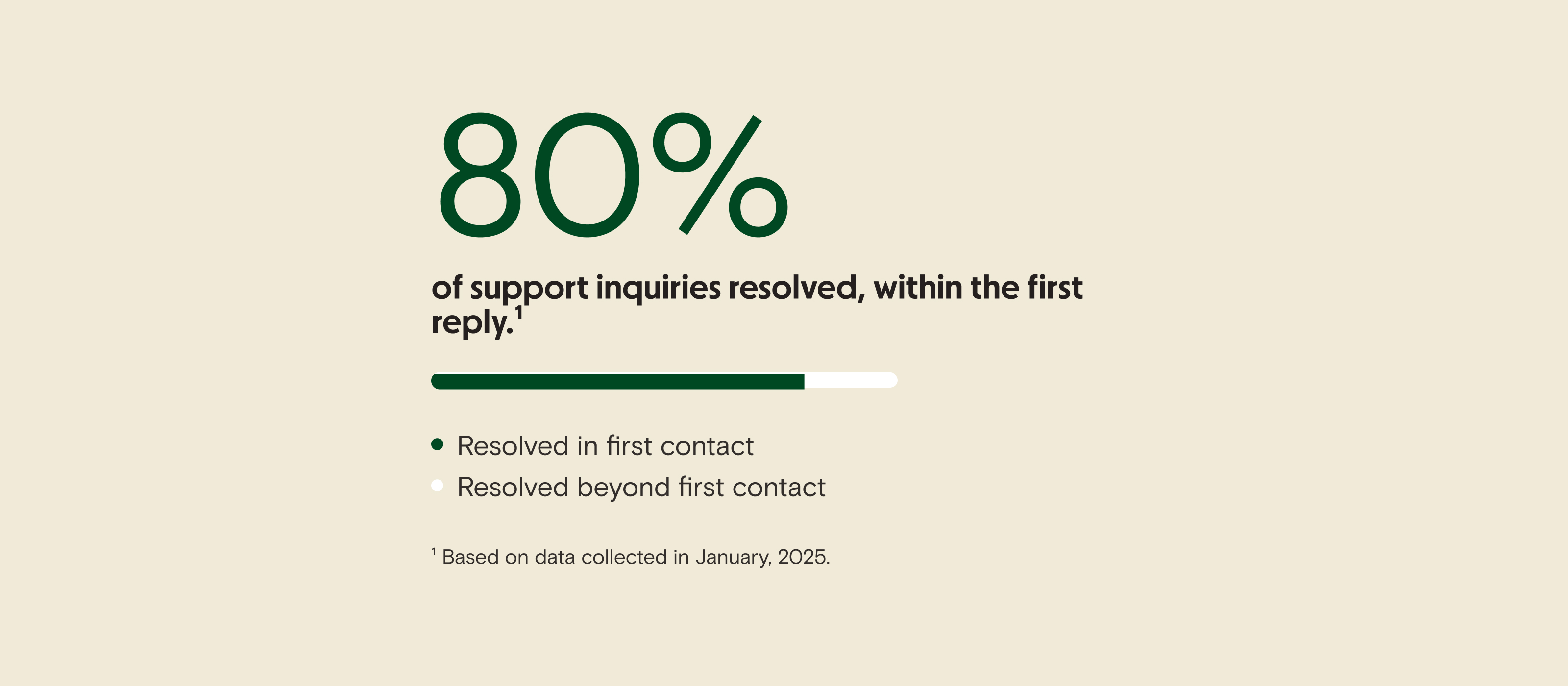

Already, our customer support resolves 80% of inquiries within their first reply (reachable via email, chat or phone at 1-888-205-9304).

The APT has improved Relay’s support for compliance and risk prevention cases even further. It has sharpened our fraud detection accuracy, and enabled faster turnaround times to investigate and clear non-fraudulent cases.

Trust is everything

I can’t promise Relay will never make mistakes when it comes to fraud detection; no banking provider can honestly say this. The truth is that risk prevention isn’t black and white. No one gets it right 100% of the time.

What I can promise is that Relay will bring transparency to this process. In banking, it’s not common to share these compliance and fraud prevention datapoints.

Trust between small business owners and their banking provider is essential. I could point to our growing customer base, or recent awards wins to show you Relay is the real deal—and we are proud of those achievements. Real trust is earned through action and communication, and so my hope with this post is that you can see and believe that this is us putting our best foot forward