At his new firm, 2Novas, he’d inherited a small team and a set of legacy clients. Everything else, however, he needed to build himself. That meant creating the firm’s new website, opening business bank accounts, structuring payroll, and refreshing the business’ brand. While shouldering this work, he was also dealing with turnover within his team and attrition within his client base.

The last thing he needed to devote extra time and energy to was a financial management system that didn’t serve his small business needs.

The expected and unexpected risks that come with buying a business

Five years ago, Dan Novalis was working as a consultant while looking for a small business to acquire and grow. “I found a small agency here in St. Louis,” he recalls. “The owner was retiring and so basically I took over his book of work. We’re a marketing agency for community banks. So we do a little bit of everything: Google Ads, Facebook ads, video, those types of things. We've got three employees and a team of contractors that we work with as well.”

Dan understood the risk involved in acquiring the business but that understanding didn’t soften the blow of having an employee leave just a week after he started. That was quickly followed by two of the firm’s biggest clients. “The first couple months were pretty rough,” he admits.

A pile of ancient VHS tapes unearthed during the process of moving the office to a new space acted as both a metaphor and a motivator: “We needed to modernize — and that carried over to the banking side too,” he says. “When you acquire a business, you get all that physical stuff, but you're a separate legal entity. I didn't acquire the bank accounts, I didn't acquire the accounting stuff. It was an interesting marriage of these new digital accounts I could start with from scratch versus all this old physical stuff.”

When your bank can’t give you what you need

“Maybe I'm just more nervous than the average person, but for me there's such a mental toll on the unquantifiable stuff — the worrying while I'm walking the dogs, the worrying while I'm trying to talk to a customer — if I don't have the money organized, I'm constantly worrying.”

In an effort to alleviate some of that worry, Dan began his journey to find a financial management strategy that was a fit for his business. The first stop was his local bank branch. He started there with just one account and used it to deposit checks, pay vendors, cover payroll, pay taxes, and fund operating expenses. "When you're doing everything yourself, there are a lot of surprises. It takes a lot more time than you think to just manage all the bills and invoices."

Minor unexpected costs like a broken laptop felt like a big deal. “Can we afford a new $2,000 machine? I didn't know,” says Dan. “There might be $50,000 in your bank account, but if you're paying out of that account to vendors, you also have to make sure you have enough for payroll before the next month of invoices comes in.”

The lack of clarity in terms of his business’s financial status was causing Dan added worry and anxiety.

“There were a few times where we bounced a check and once we bounced payroll. It wasn't like we were out of money and broke. It was that a check hadn't cleared, or we haven't gotten paid by clients. We should have had the money. It was a cash flow problem, not a profitability problem,” he explains.

“I needed somebody to look at our stuff and say, ‘Hey, there's a smarter way to do this.’”

Around a year into running his new business, Dan connected with a bookkeeper who helped him structure his finances according to the Profit First system. That bookkeeper also suggested that Dan look into banking with Relay, which gelled with Profit First’s multi-account methodology. Relay account holders have the ability to maintain up to 20 free checking accounts with no account fee or minimum balance requirements.

“I'm never going to go back to one account,” says Dan. “Even when margins were thinner, the Profit First system and the way that Relay makes it easy to manage reduces a ton of worry.”

Profit First and Relay: A recipe for financial success

The Profit First strategy is all about dividing revenue across different bank accounts. Typically, these accounts will fall under categories like Income, Operating Expenses, Owner’s Pay, Profit, and Taxes. Central to the philosophy is a Profit account. Profit First is designed to help small business owners create a profit margin on launch day, while not allowing their expenses to grow at a faster rate than their business.

<!-- EMBEDDED_ENTRY_INLINE:6miO3cNYvJKf7lnmX7tB13:inlineCta -->

Using Profit First to produce a clear picture of his agency’s finances

One of Dan’s biggest financial issues was that he didn’t have a lot of visibility into how much money he was making and what amounts he needed to put aside for payroll, taxes, and profit. He also didn’t have a sufficiently clear picture of when and where his client’s money (in the form of media spend) commingled with the rest of the agency’s cash.

“As an ad agency, we have clients who we buy digital media for. If a customer is spending a million dollars a year on an ad campaign, that million dollars flows through us, but it's not really our money,” says Dan. “We invoice the customer for that and then we pay it out to the media vendor. So Profit First makes it really easy to put money that's not ours into a separate account. Relay makes that easy, too — I can open an account in a second, I don't have to talk to anybody. I don't have to go in and fill out a long form in the bank. I can just open it when I need it and close it when I don't.”

At his old bank, it simply wasn’t possible to implement his desired financial strategy without losing money and time. “The way Profit First Works is that you've got to keep accounts at a zero balance and it's going to easily be $50 or $100 in bank fees just for doing that,” Dan says. “We had a bank we were working with, but they charged $10 a month if there's a zero balance, and they'll close the account after 90 days.”

How Profit First and Relay work together to help Dan manage his money and grow

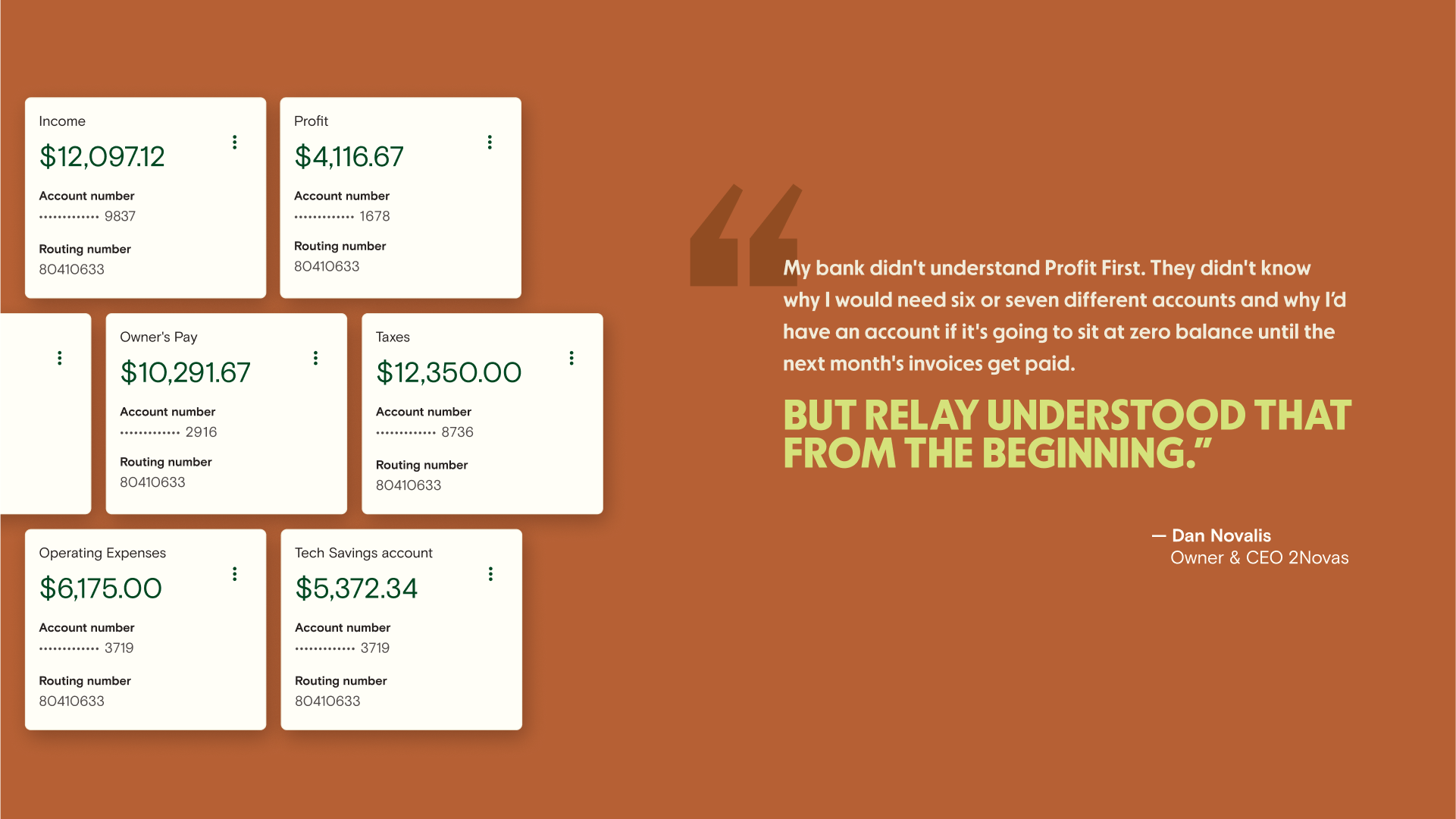

“My bank didn't understand Profit First,” says Dan. “They didn't know why I would need six or seven different accounts and why I’d have an account if it's going to sit at zero balance until the next month's invoices get paid. But Relay understood that from the beginning.”

Dan uses his agency’s media spend process as an example of how having a separate account for cost of goods sold (COGS) helps to provide him with a clearer picture of his finances. Out of a client payment of $20,000, half of that might be allocated to printing costs. As soon as that payment from the client comes in, Dan is able to put $10,000 into his COGS from which to pay the printer further down the line. “It's just much easier to put that money somewhere else — to know what's ours and to not worry about doing the math every time I log into my bank account.”

Relay, Dan says, made setting up and implementing a Profit First strategy for his business a seamless experience. “I don't even think about it, which lets me focus on going out and getting more sales. I find the allocation process really rewarding, too,” he adds. “Like, okay, I'm moving money from Income to Owner Pay and that's my money and this is why I'm doing this business thing on my own.”

For Dan, pairing Profit First with the banking tools offered by Relay not only relieved a lot of his financial stress, but it acted as a motivator, too. He could see for the first time a vision of how his business was succeeding.

“When we started that Profit account separate from the Owner Pay account,” he adds, “it was really psychologically important to say, ‘Hey, we're making profit.’ The way that Relay presents that in your account, it helps so much seeing the different buckets and being able to manage it and move money around quickly. It definitely helped us to get where we are now.”

2Novas' Profit First set up

As a marketing agency, 2Novas utilizes a modified Profit First setup to manage its money. Here's the breakdown of checking and savings accounts that Dan has:

Account | Purpose |

|---|---|

Income | All income generated by the agency is deposited into this account |

Profit | To set aside money so the business is immediately profitable |

Operating Expenses | For all company expenses (minus ad spend) |

Owner's Pay | To pay himself |

Ad Spend | As a marketing agency, clients |

Taxes | To set aside money to pay for taxes at the end of the year |

Tech Savings | To save for a new line of business |

How Relay is helping Dan add to his savings and grow his business

These days, Dan’s added another account to his Relay portfolio, one that’s aimed at setting aside a portion of his income for savings that he will use to grow his business.

“We're starting to build a technology product for banks, an analytics solution,” he says. “I want to bootstrap this for a while and see if I can get some clients on it, but it's going to cost money to hire a developer. Last year I opened up a new account and I'm going to throw 5% into that account and save up for a while. So that account holds some extra cash for that technology product.”

Dan plans to grow that aspect of his business and to ultimately devote his focus there. "I want to grow something bigger, turn this into a technology business and move along that way," he says.

How Relay can power up your Profit First banking

“If you're thinking about Profit First or you've started to implement it, I think there's no other place to go,” says Dan. “I've never gotten a fee. I can do anything I need within a couple of minutes. And I think there's an interesting realm there too for marketing agencies that are managing their client's media spend — the ability to create accounts and put that money there is amazing. I haven't run into another bank that makes it that easy.”

With Relay, business owners have access to:

Up to 20 free checking accounts, with no account fee or minimum balance requirements

Auto-transfer rules for Profit First allocations

Free check payments, mobile cheque deposits, ACH and wires

No hidden banking fees

The ability to open an account online in just 10 mins

Safe and secure banking without having to visit a physical branch

Seamless accounting software like Xero and QuickBooks Online

In less than ten minutes you can sign up for a free business banking account with Relay, right here. Want learn more? Sign up for our biweekly demo webinar to learn more about how to manage cash with Relay.

<!-- EMBEDDED_ENTRY_INLINE:2V958SGt3ptRVlMhL96W5w:unknown -->